September 5, 2023

This is the Commodities, Scrap Metal, Recycling and Economic Report, September 5th, 2023. Note, Most data here, is ending with last Friday September 1st.

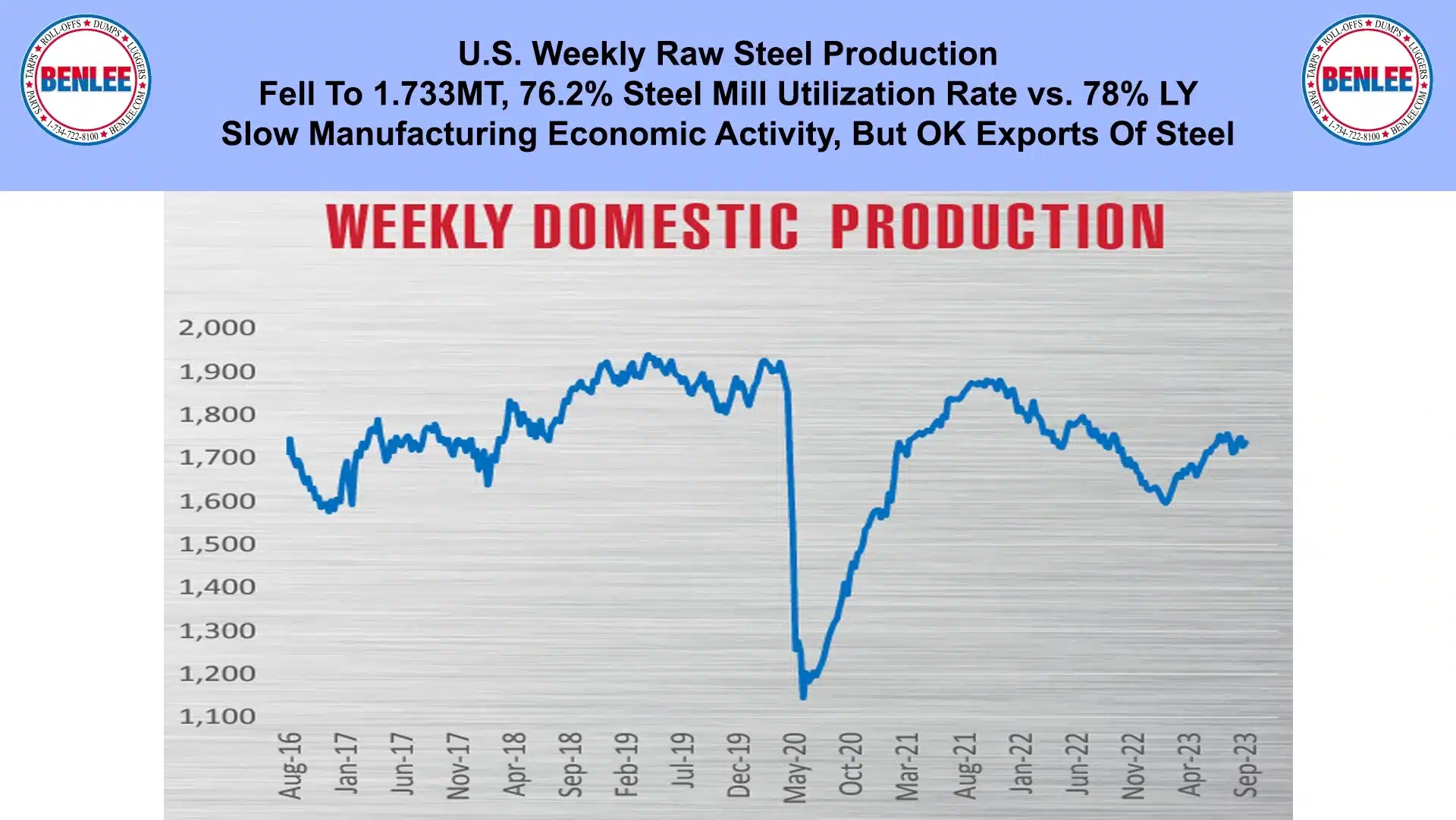

U.S. weekly raw steel production fell to 1.733MT a 76.2% steel mill utilization rate. This was on slow manufacturing economic activity, but OK exports of steel.

WTI crude oil price rose to $85.23/b., on continued OPEC+ production cuts and slow demand increases.

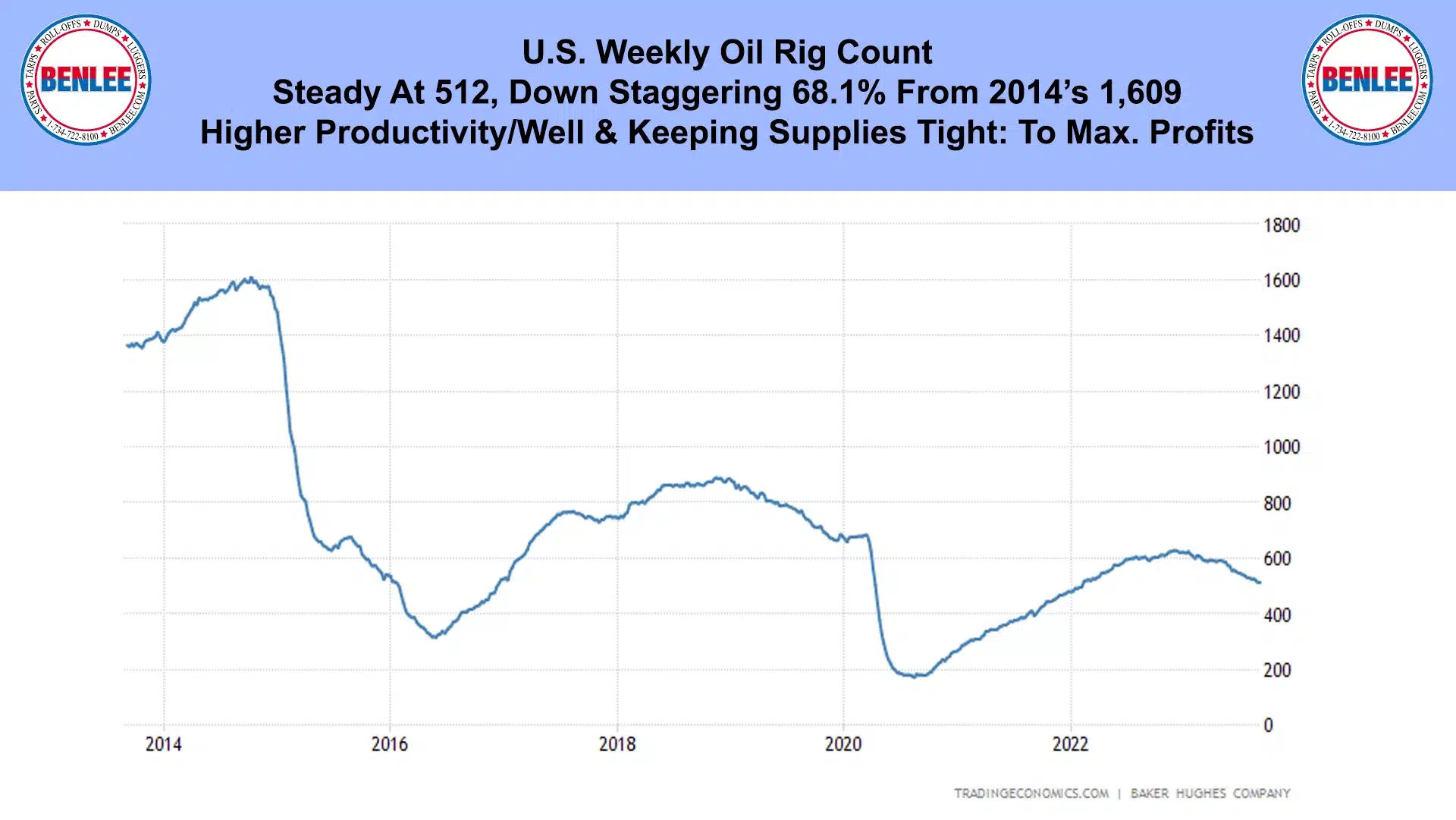

The U.S. weekly oil rig count was steady at 512, down a staggering 68.1% from 2014’s high of 1,609. Moreover, this was on higher productivity per well and keeping supplies tight to maximize profits.

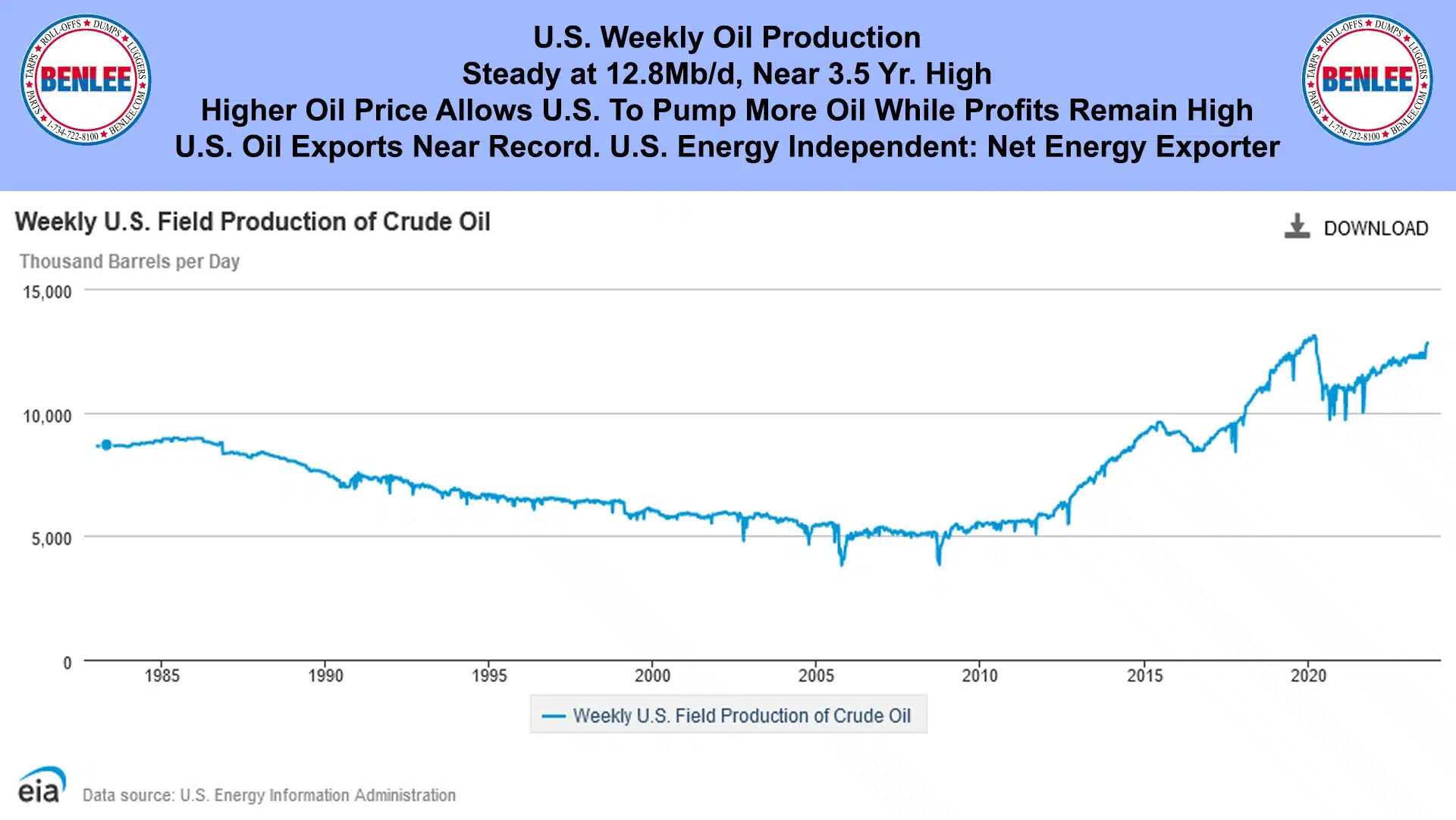

U.S. weekly crude oil production was steady at 12.8Mb/d., near a 3.5 year high. The higher oil price allows the U.S. to pump more oil while profits remain high. U.S. oil exports remain near a record. The U.S. is not only energy independent, but we are a net energy exporter.

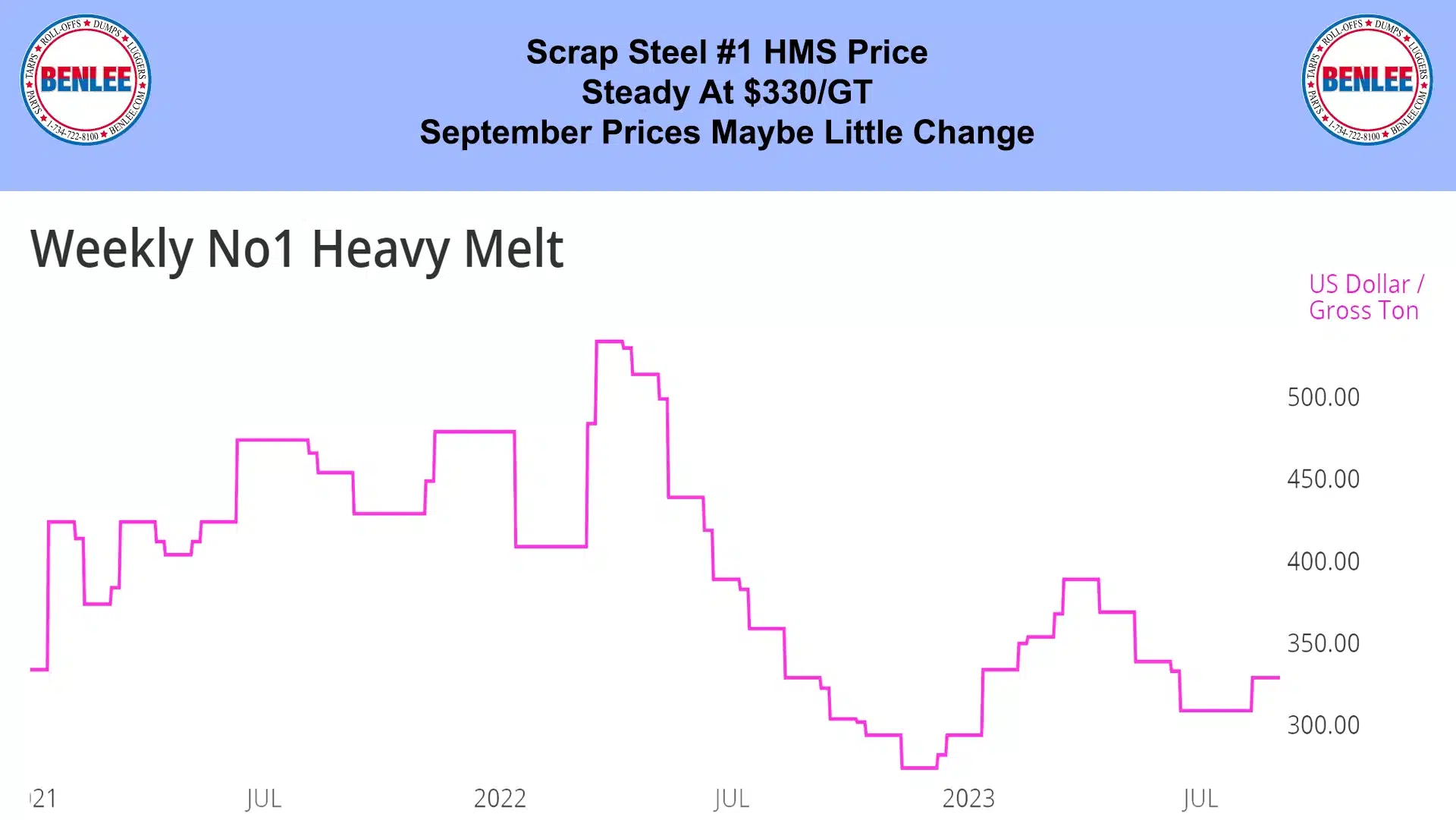

Scrap Steel #1 HMS price was steady at $330/GT. September prices maybe little changed.

Hot-rolled coil steel price fell to $35.74/cwt., $715/T on slow manufacturing activity.

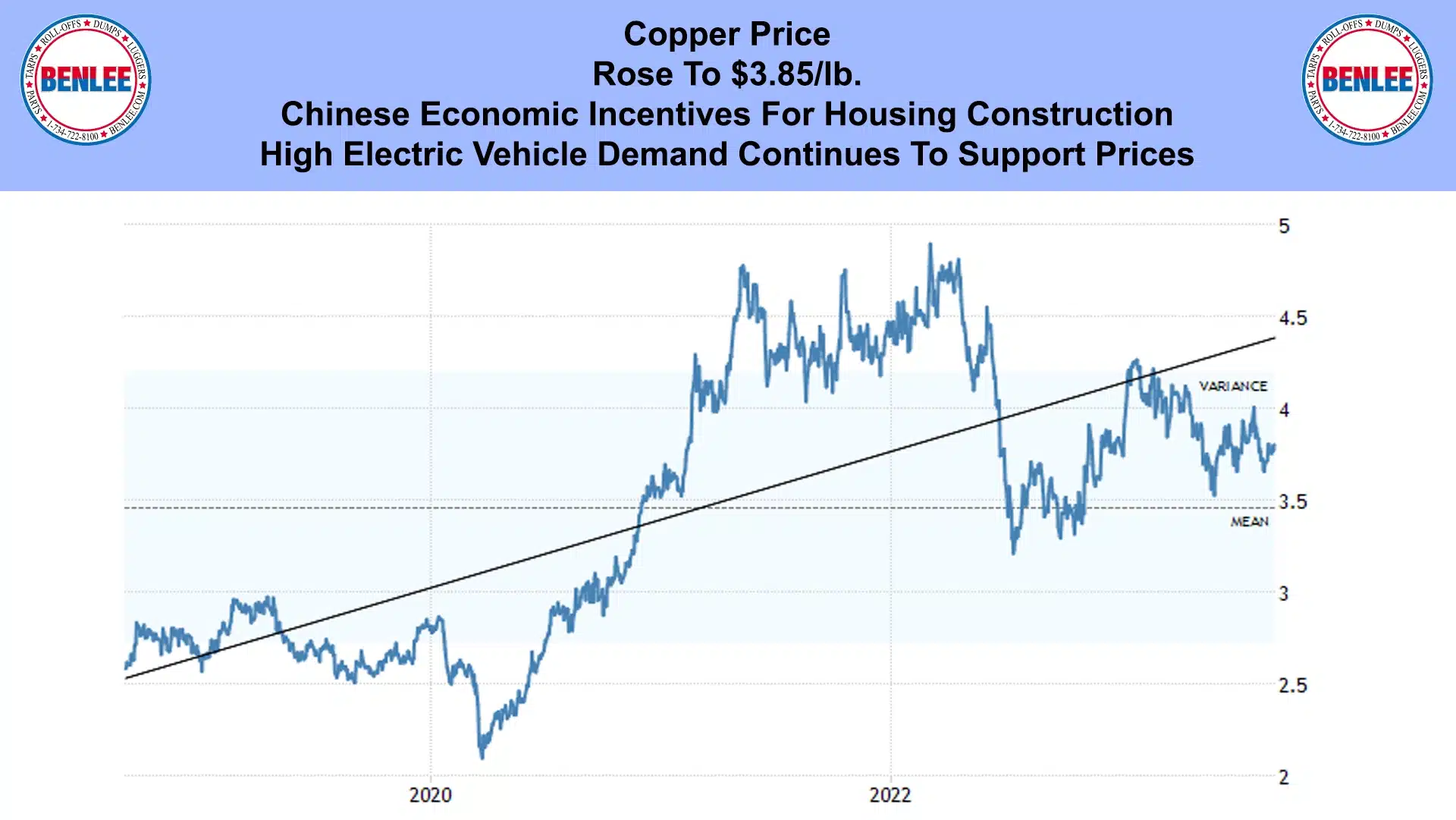

Copper price rose to $3.85/lb., on Chinese economic invectives for housing construction. Also, high electric vehicle demand continues to support prices.

Aluminum price rose to $1.02/lb., $2,240/mt on reduced Chinese production to cut pollution.

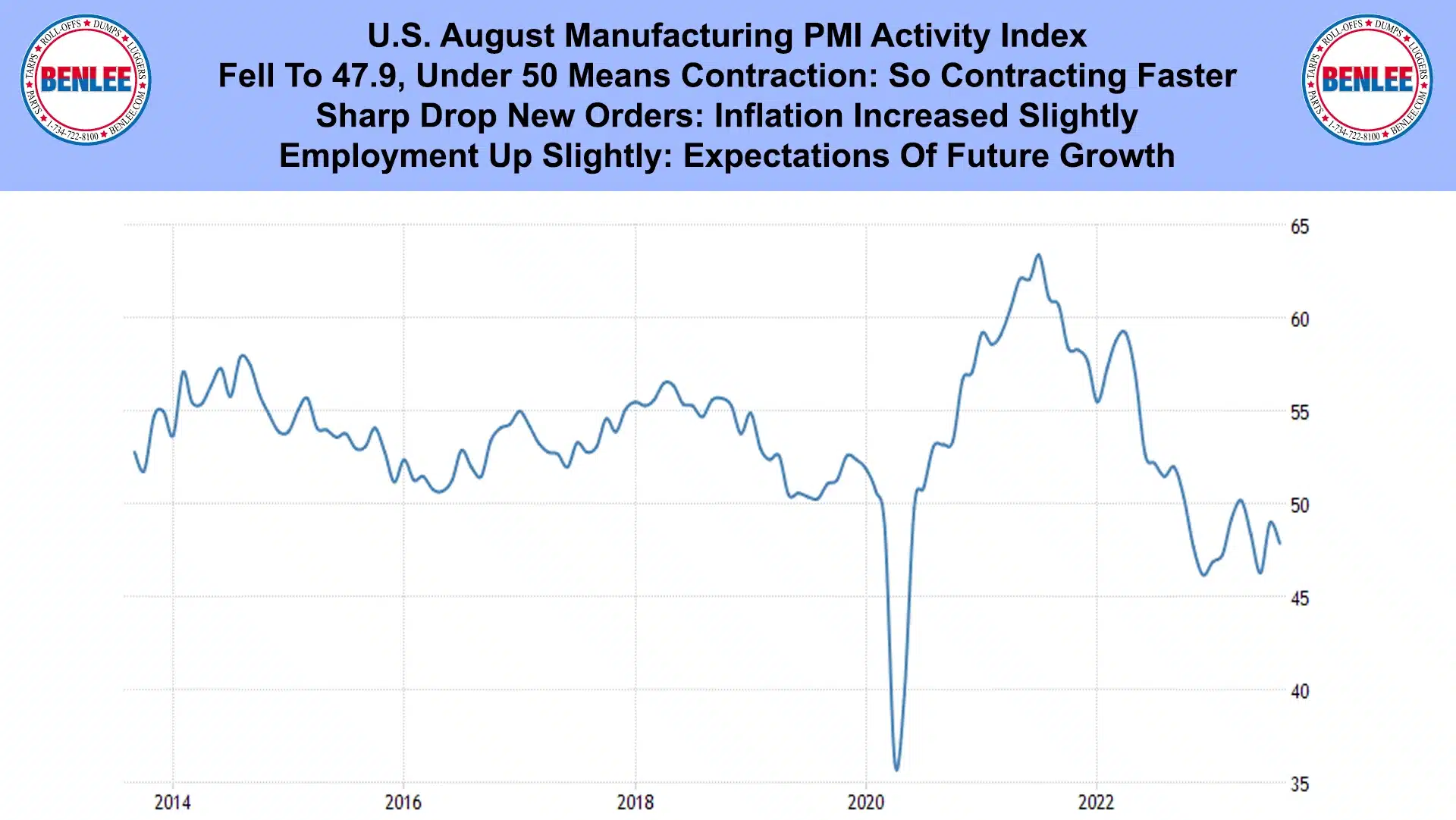

U.S. August Manufacturing PMI activity index fell to 47.9, while under 50 means contraction so manufacturing is contracting faster. Also, this was on a sharp drop in new orders and inflation increased slightly. Related, employment was up slightly on expectations of future growth.

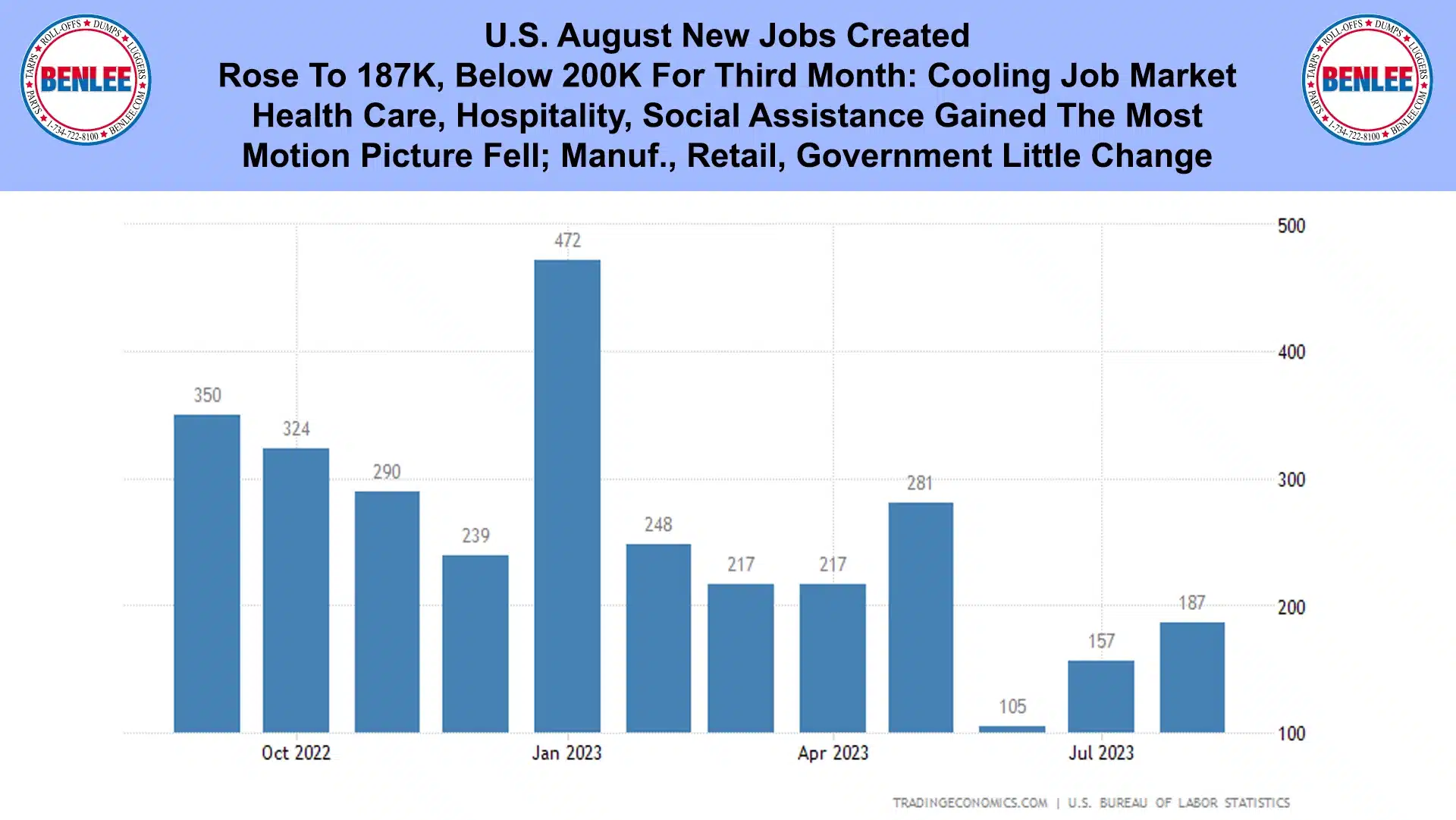

U.S. August new jobs created rose to 187,000, which was below 200,000 for the third month so there is a cooling job market. Health care, hospitality and social assistance gained the most. Motion picture fell while manufacturing, retail and government had little change.

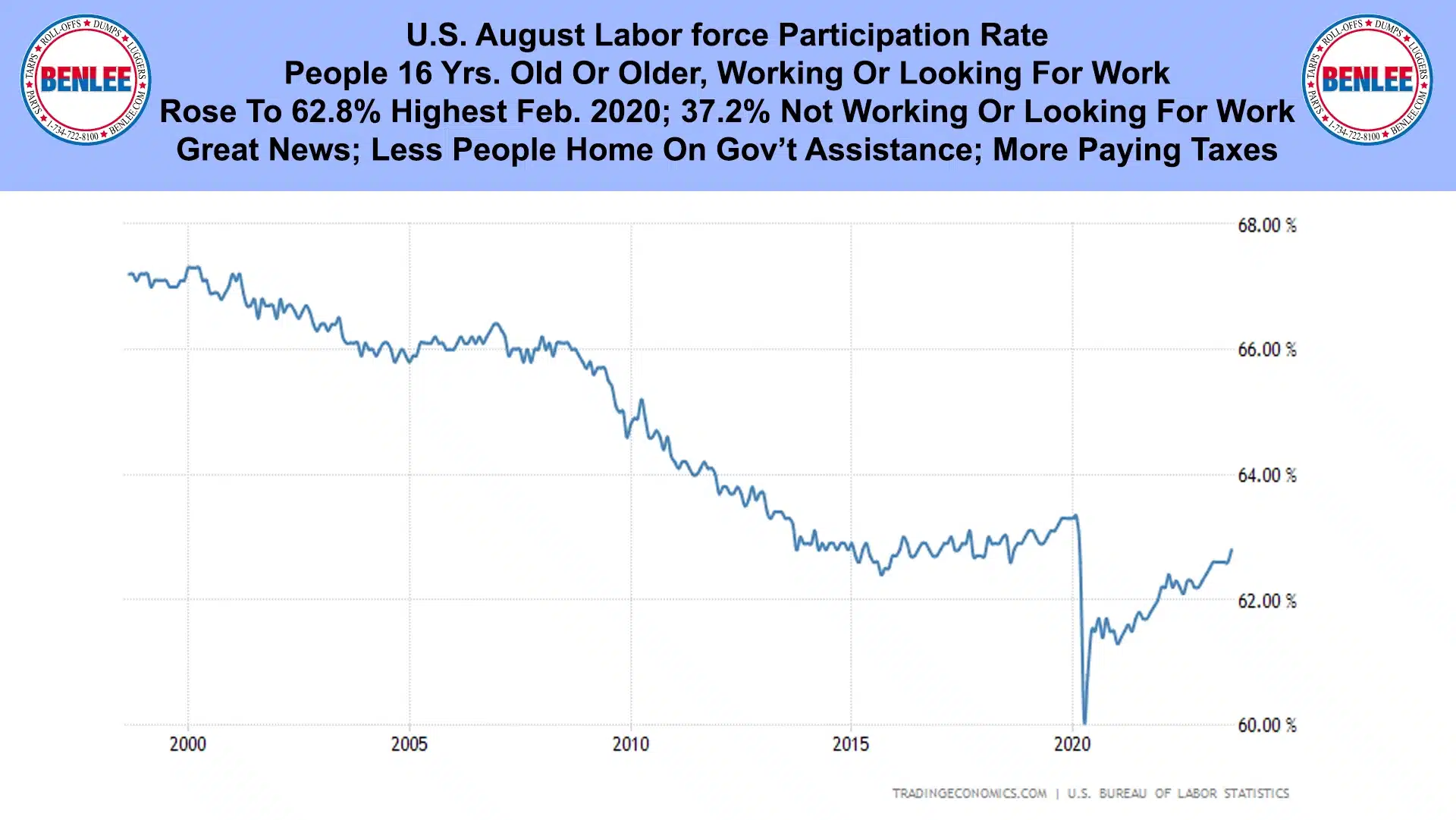

U.S. August labor force participation rate. Remember this is people 16 years old or older that are working or looking for work. It rose to 62.8%, the highest since February 2020, so 37.2% of people are not working, nor even looking for work. This increase is great news in that there are less people sitting home on government assistance, and are now paying taxes.

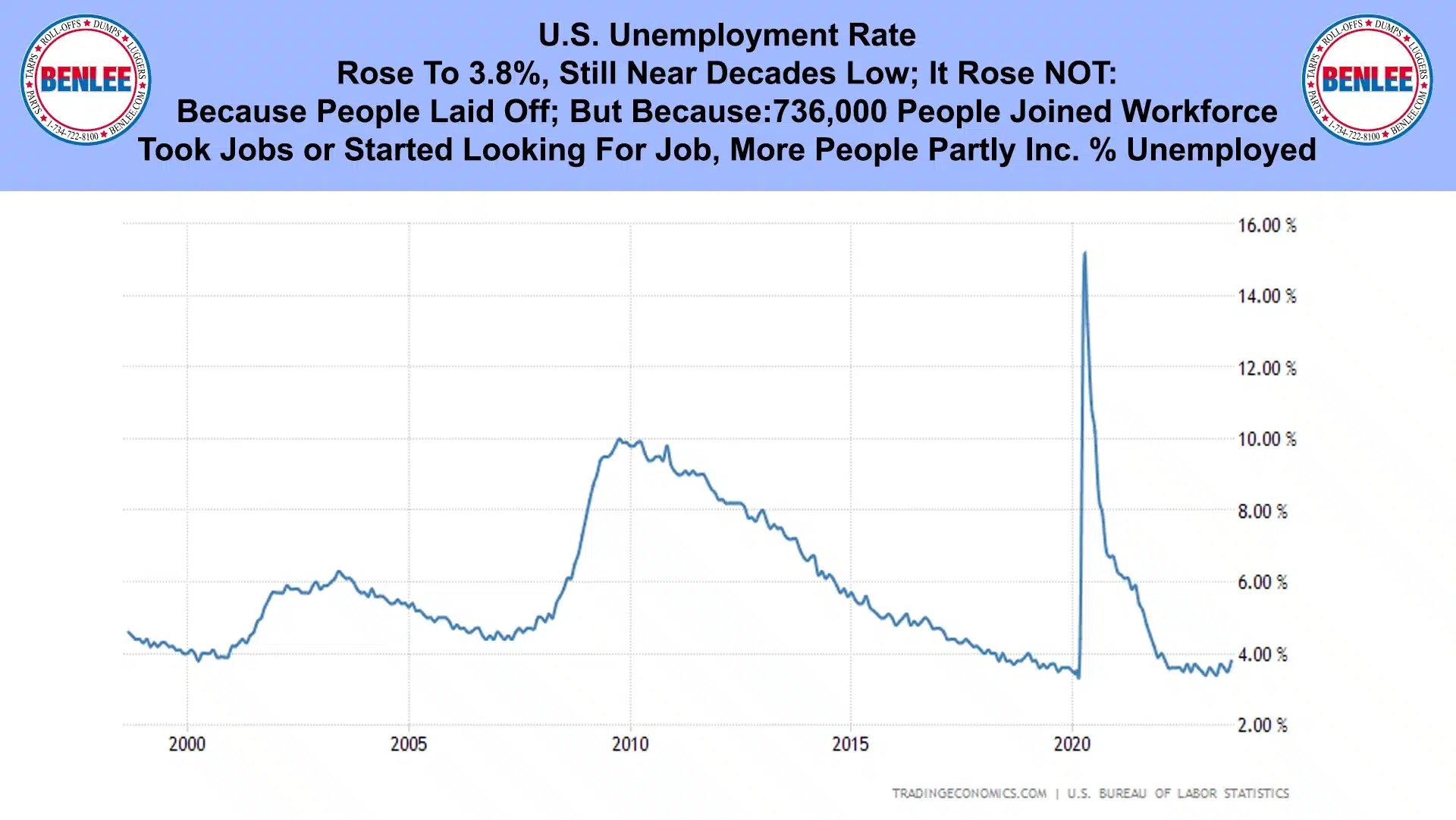

U.S. unemployment rate rose to 3.8%, which is still near decades low. It rose not because people were laid off, but because 736,000 people joined the workforce. They took jobs or started looking for work, so the more people partly increases the percent unemployed.

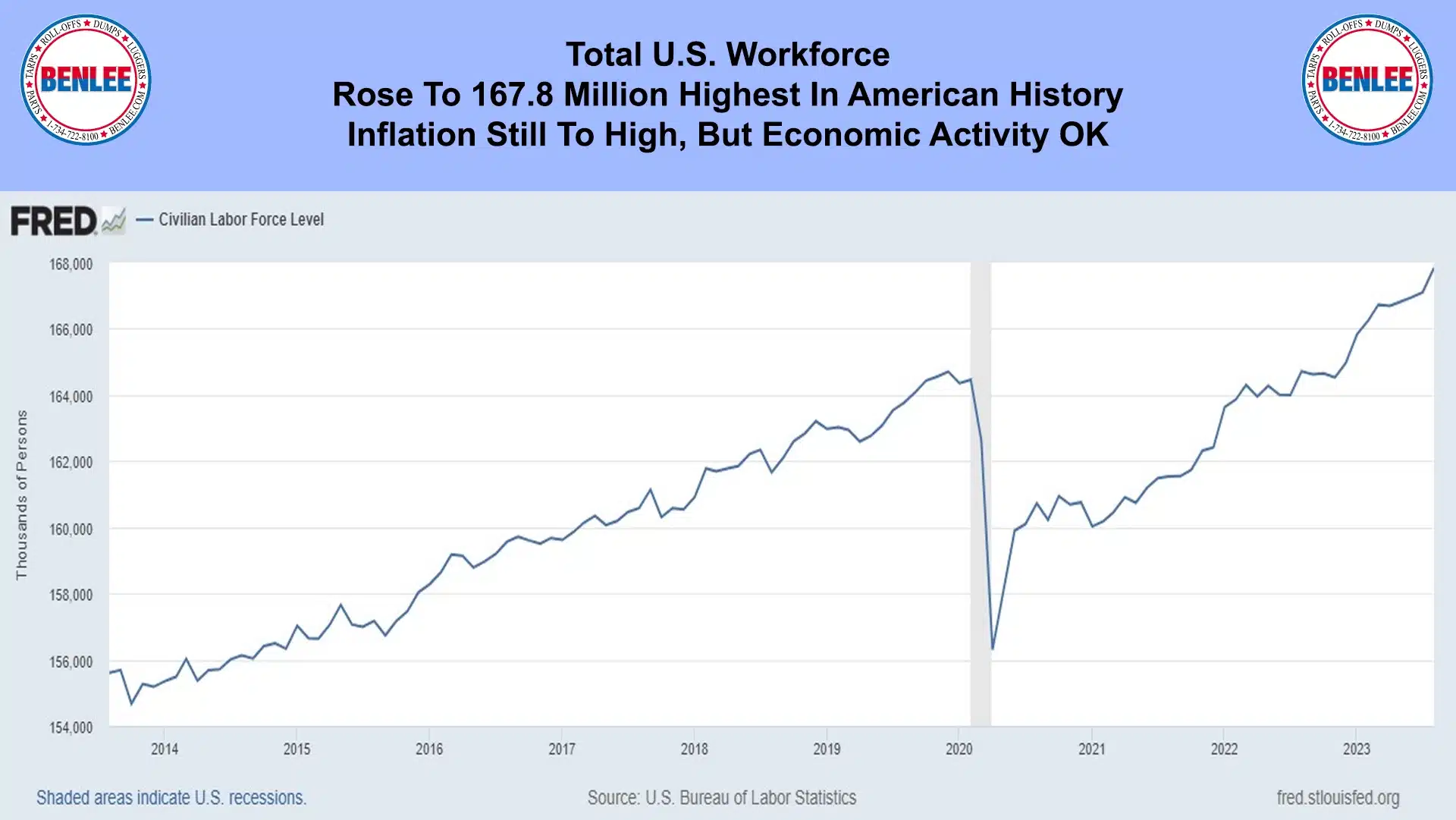

Total U.S. workforce rose to 167.8 million people, the highest in American history. Inflation is still too high, but economic activity is OK.

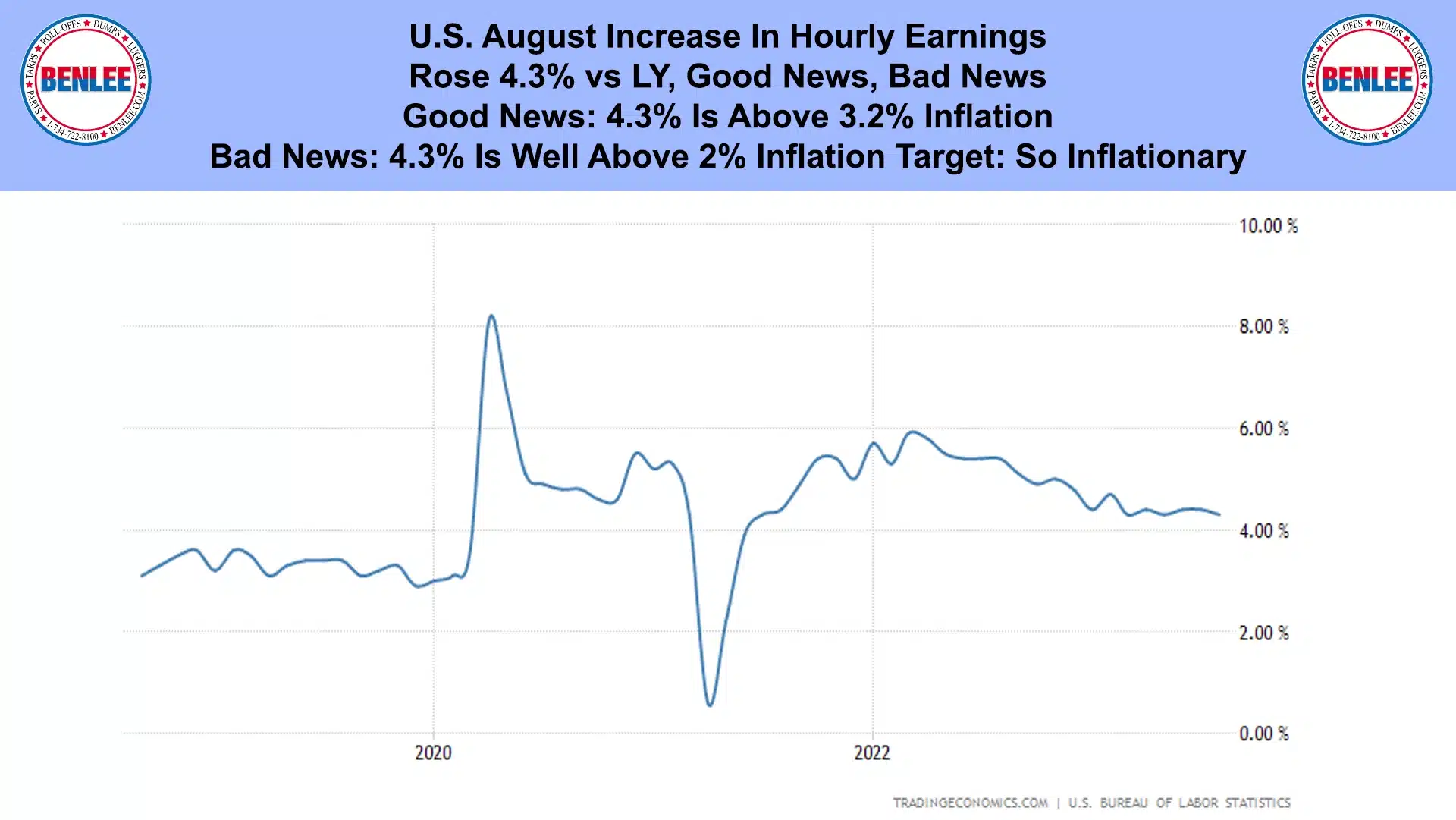

U.S. August increase in hourly earnings. Rose to 4.3% vs last year. This is good news and bad news. The good news 4.3% is above the current 3.2% inflation. The bad new is 4.3% is well above the 2% inflation target so it is inflationary.

Wall Street’s Dow Jones Industrial Average fell 337 points to 34,835 on lower jobs data that was positive, but on some poor corporate earnings.

Roll off trailers by BENLEE. BENLEE has a full product line from our 25′ 11 tandem axle to the 50′ 8 axle. All are heavy duty, but optimized to carry the most weight.

This report is brought to you by BENLEE roll off trailers, gondola trailers, lugger trucks and roll off trailer parts.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.