September 29, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, September 29th, 2025, by BENLEE produced to support our customers, suppliers, and partners.

U.S. weekly raw steel production fell slightly to 1.754MT up 5.9% from last year and up 2.1% year to date. This was on tariff protection and slow U.S. manufacturing.

WTI crude oil rose to $65.19/b. This was on Ukraine’s attacks on Russian energy infrastructure. Also, on the U.S. pressure on countries to reduce Russian oil purchases.

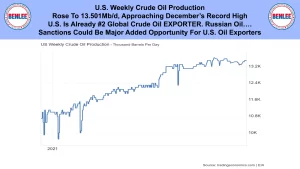

U.S. weekly crude oil production rose to 13.501Mb/d., approaching December’s record high. The U.S. is already the #2 global crude oil exporter, yes exporter of crude oil and Russian oil sanctions could be a major opportunity for U.S. oil exporters.

The U.S. weekly crude oil rig count rose to 424 and has been trending up. Oil companies are possibly positioning for increased exports if Russian oil sanctions happen.

Scrap steel #1 HMS price composite remained steady at $311.67/GT on a good balance of supply and demand. Some scrap grades are under downward price pressure for October.

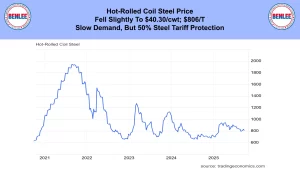

Hot-Rolled coil steel price fell slightly to $40.30/cwt., $806/T on slow demand, but the 50% tariff protection.

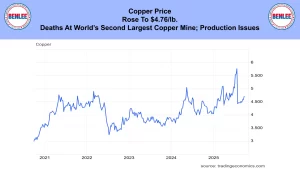

Copper price rose to $4.76/lb., on deaths at the world’s second largest copper mine which is causing production issues.

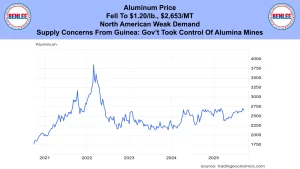

Aluminum price fell to $1.20/lb., $2,653/MT on North American weakened demand. There have also been supply concerns from Guinea as the government took control of the country’s alumina mines.

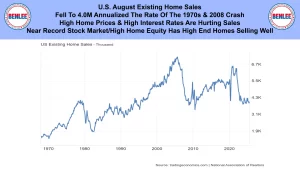

U.S. August existing home sales fell to 4.0M annualized, the rate of the 1970s and the 2008 crash. High home prices and high interest rates are hurting sales. The near record stock market and high home equity has high end homes selling fairly well though.

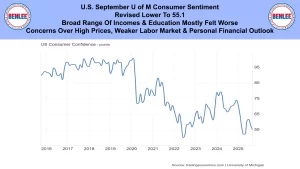

U.S. September U of M consumer sentiment was revised lower to 55.1. A broad range of income and education mostly felt worse. The concerns are over high prices, the weaker labor market and their personal financial outlook.

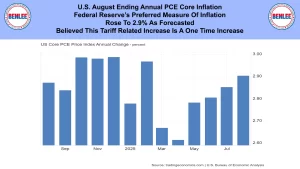

U.S. August ending annual PCE core inflation, the federal reserve’s preferred measure of inflation. It rose to 2.9% as forecasted. It is believed this tariff related increase is a one-time increase.

U.S. August personal spending increased by .6% the sharpest increase in 5 months. There is a strong consumer despite the heightened uncertainty, which is great news.

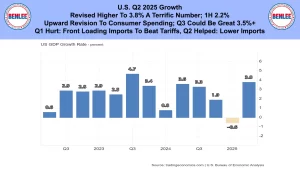

U.S. Q2 2025 growth was revised higher to 3.8% a terrific number which makes the 1H 2.2%. This was on the upward revision to consumer spending. Also, Q3 could be a great 3.5% or more. Q1 was hurt by front loading imports to beat tariffs. Q2 was helped by lower imports, due to the Q1 import surge.

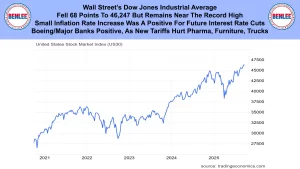

Wall Street’s Dow Jones Industrial Average fell 68 points to 46,247 but remaining near the record high. The small inflation rate increase was a positive for future interest rate cuts. Boeing and major banks were positive and the new tariffs hurt Pharmaceuticals, Furniture and Truck companies.

This report is brought to you by BENLEE Roll-off trailers, Gondola Trailers, Lugger Trucks and Roll-off trailer parts and Roll-off truck parts. This is Greg Brown reporting. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.