October 27, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, October 27th, 2025, produced by BENLEE Roll off trailers to support our customers, suppliers, and partners.

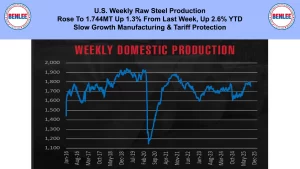

U.S. weekly raw steel production rose to 1.744MT up 1.3% from last week and up 2.6% year to date. This was on slow growth manufacturing and tariff protection.

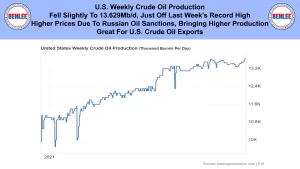

WTI crude oil price jumped to $61.50/b., on new Russian Oil sanctions. Also, on Chinese and Indian cuts of Russian oil purchases.

U.S. weekly crude oil production fell slightly to 13.629Mb/d, just off last week’s record high. Higher prices due to Russian oil sanctions are bringing higher production. This is great for U.S. crude oil exports.

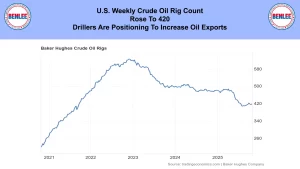

The U.S. weekly crude oil rig count rose to 420 as drillers are positioning to increase oil exports.

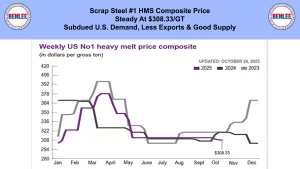

Scrap steel #1 HMS price composite was steady at $308.33/GT on subdued U.S. demand, less exports and good supply.

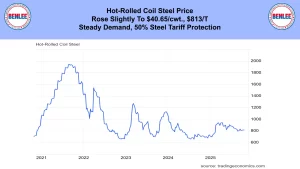

Hot-Rolled coil steel price rose slightly to $40.65/cwt. $813/T on steady demand and 50% tariff protection.

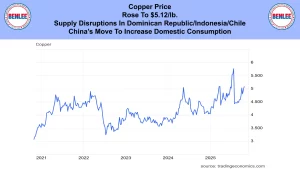

Copper price rose to $5.12/lb., on supply disruptions in the Dominican Republic, Indonesia, and Chile. Also, on China’s move to increase domestic consumption.

Aluminum price rose to $1.30/lb., $2,859/MT on tight supply from China and Iceland.

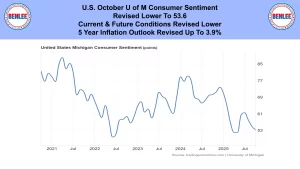

U.S. October U of M Consumer Sentiment was revised lower to 53.6 as current and future conditions were revised lower. Also, the 5 year inflation outlook was revised up to 3.9%.

U.S. September existing home sales rose to 4.06M annualized, but near the level of the 2008 crash and the rate of 1978, 47 years ago. This was on high, but recently lower mortgage rates and record high and increasing home prices.

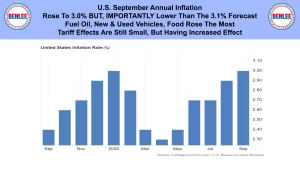

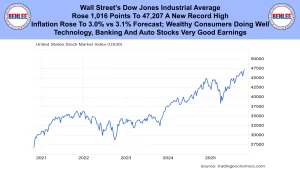

U.S. September annual inflation rose to 3.0%, but importantly lower than the 3.1% forecast. Fuel oil, new and used vehicles and food rose the most. Tariff effects are still small, but having an increased effect.

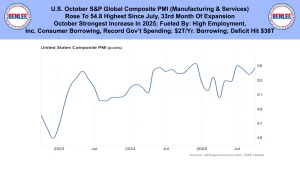

U.S. October S&P global manufacturing PMI, purchasing managers’ index rose to 52.2 on improved factory conditions. There was the sharpest rise in new orders in 20 months.

U.S. October S&P global Composite PMI, which is manufacturing and services combined, rose to 54.8 the highest since July and the 33rd month of expansion. October was the strongest increase in 2025. This was fueled by high employment, increased consumer borrowing, and record government spending with $2T/yr government borrowing, as the total deficit just hit $38T.

Wall Street’s Dow Jones Industrial Average rose 1,016 points to 47,207 a new record high. This was as inflation rose to 3.0% vs the 3.1% forecast. Wealthy consumers are doing well and spending. Technology, banking, and auto stocks reported very good earnings.

This report is brought to you by BENLEE Roll-off trailers, Roll off trucks, Gondola Trailers, Lugger Trucks, Roll-off trailer parts, Roll-off truck parts and dump truck and trailer parts. This is Greg Brown reporting. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.