October 13, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, October 13th, 2025, produced by BENLEE Roll off trailers to support our customers, suppliers, and partners.

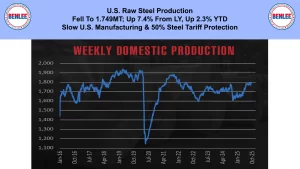

U.S. weekly raw steel production fell to 1.749MT up 7.4% from last year and up 2.3% year to date. This was on slow U.S. manufacturing and 50% steel tariff protection.

WTI crude oil price fell to $58.20/b., as Chinese oil demand is forecasted to decline starting in 2026. This is on massive Chinese spending on wind and solar, as 50% of all new Chinese cars are electric vehicles. Also, on the warning by the U.S. of new additional Chinese tariffs, which we seemed to have backed off of yesterday.

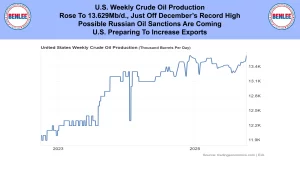

U.S. weekly crude oil production rose to 13.629Mb/d, just off December’s record high. Possible Russian oil sanctions are coming so the U.S. is preparing to increase exports. Note that the U.S. is already the #2 crude oil exporter.

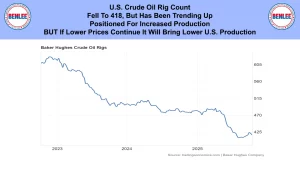

The U.S. weekly crude oil rig count fell to 418 but has been trending up as we are positioned to increase production further. But if lower prices continue they will bring lower U.S. production.

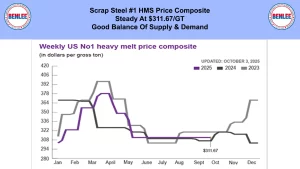

Scrap steel #1 HMS price composite was steady at $311.67/GT on a good balance of supply and demand.

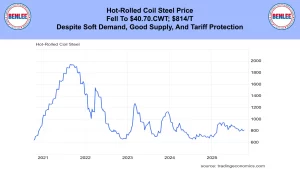

Hot-Rolled coil steel price fell to $40.70/cwt., $814/T despite soft demand, good supply and tariff protection.

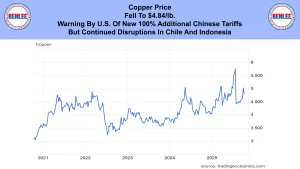

Copper price fell to $4.84/lb., on the warning by the U.S. of new 100% additional Chinese tariffs, but continued supply disruptions in Chile and Indonesia.

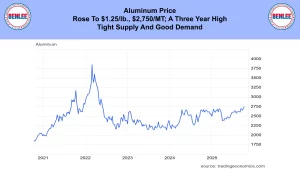

Aluminum price rose to $1.25/lb., $2,750/MT a three year high on tight supply and good demand.

U.S. Dollar index, which is the U.S. currency vs other global currencies. When the U.S. dollar falls, commodities priced in dollars typically rises. It fell 1% for the week to 99. This was mostly due to political uncertainty in France and Japan.

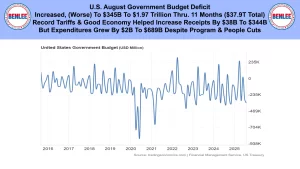

U.S. August government budget deficit, increased as in worse, to $345B to $1.97T through 11 months for a total of $37.9T. Record tariffs and the good economy helped increase receipts by $38B to $344B, but expenditures grew by $2B to $689B despite program and people cuts.

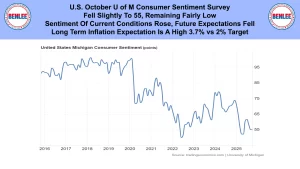

U.S. October U of M consumer sentiment survey fell slightly to 55, remain fairly low. Sentiment of current conditions rose and future expectations fell. The long term inflation expectation is a high 3.7% vs the government’s 2% target.

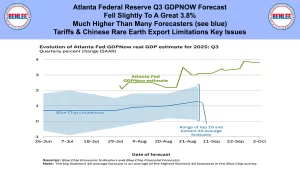

Atlanta Federal Reserve Q3 GDPNOW forecast fell slightly to a great 3.8% which is much higher than many forecasters, see the blue line. Tariffs and Chinese rare earth export limitations are key issues.

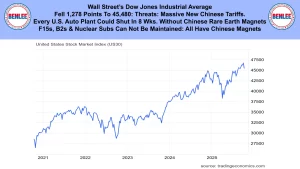

Wall Street’s Dow Jones Industrial Average fell 1,278 points to 45,480 on threats of massive new Chinese tariffs which as said we seemed to have backed off of yesterday. Every U.S. Auto plant could shut in 8 weeks without Chinese rare earth magnets. Worse is that F15s, B2 bombers and nuclear submarines cannot be maintained in that they all have Chinese rare earth magnets.

This report is brought to you by BENLEE, Gondola Trailers, Lugger Trucks and Roll-off trailer parts and Roll-off truck parts. This is Greg Brown reporting.

As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.