January 5, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, January 5th, 2026, produced by BENLEE Roll off trailers to support our customers, suppliers, and partners.

U.S. weekly raw steel production fell to 1.695MT down 1.7% from last week and up 3.4% year to date. This was on slow U.S. demand from U.S. Steel Mills despite the 50% steel tariff protection. Note that U.S. manufacturing jobs are down in past 12 months

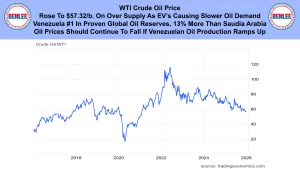

WTI weekly crude oil price rose to $57.32/b. on over supply as electric vehicles are causing slower oil demand. Venezuela is #1 in proven oil reserves, 13% more than Saudi Arbia. Oil prices should continue to call if Venezuelan oil production ramps up.

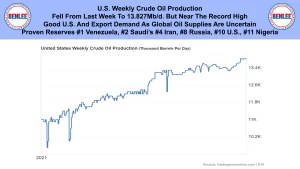

U.S. weekly crude oil production fell from last week to 13.827Mb/d., but near the record high. On good U.S. and export demand as global oil supplies are uncertain. Proven oil reserves are #1 Venezuela, #2 Saudi Arabia, #4 Iran, #8 Russia, #10 U.S., #11 Nigeria.

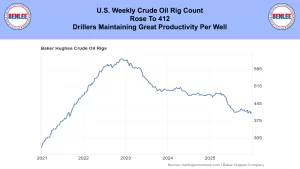

The U.S. weekly crude oil rig count rose to 412 as drillers are maintaining great productivity per well.

The U.S. dollar index, as in the Dollar strength vs other global currencies. When the U.S. dollar declines, commodities priced in dollars tends to rise. It fell to 98.2 down 9% in 2025 the biggest drop in 8 years on lower U.S. interest rates. This helps lower prices of U.S. exports that other countries buy from us.

Scrap steel #1 HMS price composite was steady at $328.33/GT on slow U.S. demand. The weak U.S. dollar is helping scrap exports. Also, the bad weather is hurting supply as U.S. demand is steady. China’s steel exports are hurting global steel production, which hurts export scrap demand.

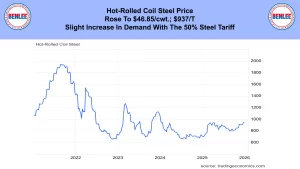

Hot-Rolled coil steel price rose to $46.85/cwt., which is $937/T on a slight increase in demand with the 50% steel tariff protection.

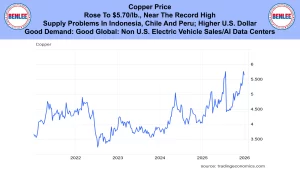

Copper price rose to $5.70/lb., near the record high. This was on supply problems in Indonesia, Chile, and Peru as well as the higher U.S. dollar. Also, on good demand due to good global non U.S. electric Vehicle sales and AI Data centers.

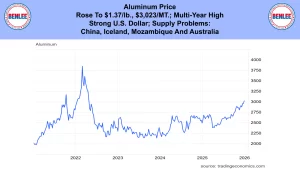

Aluminum price rose to $1.37/lb., which is $3,023/MT. a multi-year high. This was on the strong U.S. dollar and supply problems in China, Iceland, Mozambique, and Australia.

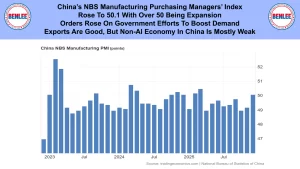

China NBS Manufacturing Purchasing managers’ index rose to 50.1 with over 50 being expansion. Orders rose on government efforts to boost demand. Exports are good, but the non AI economy in China is mostly weak.

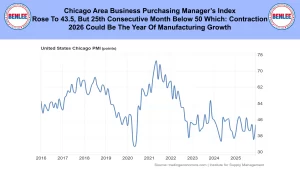

Chicago area business purchasing managers’ index rose to 43.5, but it’s the 25th consecutive month below 50 which is contraction. 2026 could be the year of manufacturing growth.

Case-Shiller October 20-City Home Price index rose 1.3% vs last year the smallest increase since July 2023. Overall inflation is about 2.8% so inflation adjusted homes are more affordable.

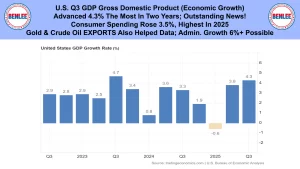

U.S. Q3 GDP gross domestic product, which is economic growth. It advanced 4.3% the most in two years, which was outstanding news. Consumer spending rose 3.55% the highest in 2025. Gold and crude oil exports also helped the data. The administration thinks growth of 6% or more is possible.

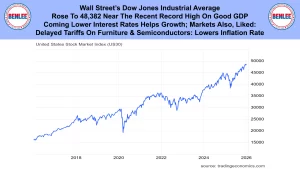

Wall Street’s Dow Jones Industrial Average rose to 48,382 near the recent record high on good GDP. Also, as the coming lower interest rates helps growth. Markets also liked the coming delayed tariffs on furniture and semiconductors, which lowers the inflation rate.

This report is brought to you by BENLEE Roll-off trailers, Roll off trucks, Gondola Trailers, Lugger Trucks, Roll-off trailer parts, Roll-off truck parts and dump truck and trailer parts. This is Greg Brown reporting.

As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.