September 22, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, September 22nd, 2025.

U.S. weekly raw steel production fell to 1.764MT up 6.5% from last year and up 2.0% year to date. This was on the slow growth U.S. economy and 50% steel tariff protection.

WTI crude oil rose to $62.72/b. despite robust global production. Possible sanctions on Russian oil remain a concern for the markets.

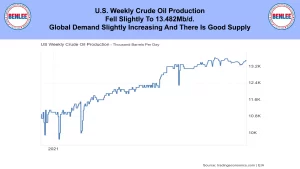

U.S. weekly crude oil production fell slightly to 13.482Mb/d. Global demand is slightly increasing and there is a good supply.

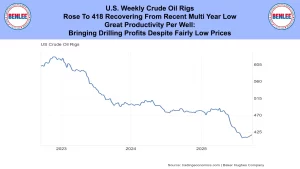

The U.S. weekly crude oil rig count rose to 418 recovering from the recent multi-year low. This was on great productivity per well, bringing drilling profits despite fairly low prices.

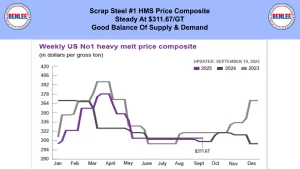

Scrap steel #1 HMS price composite remained steady at $311.67/GT on a good balance of supply and demand.

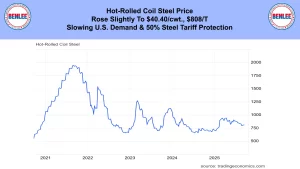

Hot-Rolled coil steel price rose slightly to $40.40/cwt. which is $808/T. This was on slowing U.S. demand and 50% steel tariff protection.

Copper price fell to $4.63/lb., on stronger supply with good demand.

Aluminum price fell to $1.21/lb., $2,673/MT remaining fairly high on 50% tariffs and lower inventories.

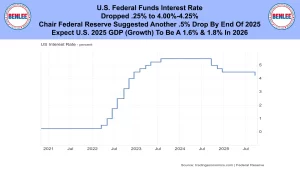

U.S. Federal Funds Interest Rate dropped .25% to 4.00% to 4.25%. The Chair of the Federal Reserve suggested that there could be another .5% drop by the end of 2025. He also said they expect U.S. 2025 GDP growth to be 1.6% and 1.8% in 2026.

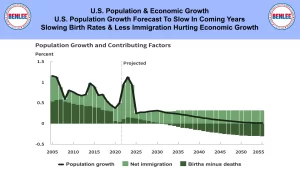

U.S. population and economic growth. U.S. population growth is forecast to slow in the coming years. Slowing birth rates and less immigration is hurting economic growth.

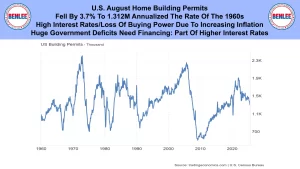

U.S. August home building permits fell by 3.7% to 1.312M annualized the rate of the 1960s. This was on high interest rates and loss of buying power due to increasing inflation. Huge government deficits need financing, which is part of the reason causing higher interest rates.

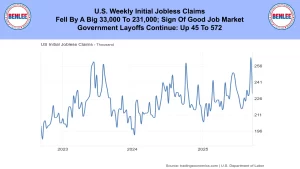

U.S. weekly initial jobless claims fell by a big 33,000 to 231,000 which is a sign of a good job market. Government layoffs continue and were up 45 to 572.

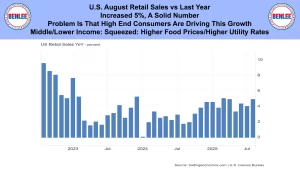

U.S. August retail sales vs last year increased 5% which is a solid number. The problem is that high end consumers are driving the growth. Middle and lower income are being squeezed by higher food prices and higher utility rates.

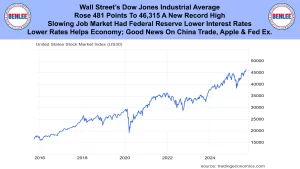

Wall Street’s Dow Jones Industrial Average rose 481 points to 46,315 a new record high. The slowing job market had the federal reserve lower interest rates as we discussed. Lower rates helps the economy. There was also good news on China trade, Apple and Federal Express.

This report is brought to you by BENLEE Roll-off trailers, Gondola Trailers, Lugger Trucks and Roll-off trailer parts and Roll-off truck parts. This is Greg Brown reporting.

As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.