September 2, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, September 2nd, 2025.

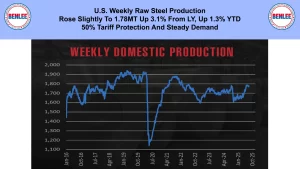

U.S. weekly raw steel production rose slightly to 1.78MT up 3.1% from last year and up 1.3% ytd. This was on the 50% steel tariff protection and steady demand.

WTI crude oil price rose to $64.01/b. despite weaker U.S. demand on from our slow growth economy. Importantly, China, India and Russia met last week as a rivel front to the U.S.

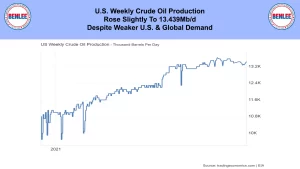

U.S. weekly crude oil production rose slightly to 13.439 Mb/d. despite weaker U.S. and global demand.

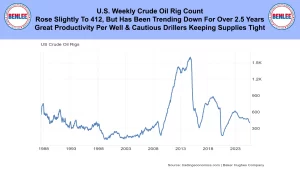

The U.S. weekly crude oil rig count rose slightly to 412 but has been trending down for over 2.5 years. This was on great productivity per well and cautious drillers keeping supplies tight.

Scrap steel #1 HMS price composite was steady at $311.67/GT on steady demand and a good supply. There is downward pressure on prices for September.

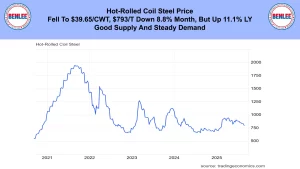

Hot-Rolled coil steel price fell to $39.65/cwt., which is $793/T down 8.8% for the month but up 11.1% from last year. This was on a good supply and steady demand.

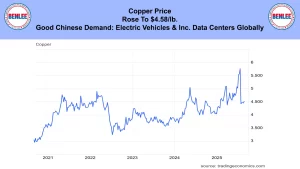

Copper price rose to $4.58/lb. on good Chinese demand for electric vehicles and increased data centers globally.

Aluminum price fell slightly to $1.19/lb., $2,620/MT despite lower supply and steady demand.

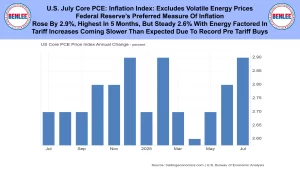

U.S. July core PCE Inflation index which excludes volatile energy prices. This is the Federal Reserve’s preferred measure of inflation. It rose by 2.9% the highest in 5 months, but was a steady 2.6% with energy factored in. Tariff increases are coming slower than expected due to record pre tariff buys.

U.S. July goods trade deficit widened as in got worse by $18.7B to $103.6B. Imports jumped 7.1% led by industrial supplies as exports fell .1%. Bringing manufacturing back to the U.S. called onshoring is not showing up in the data yet.

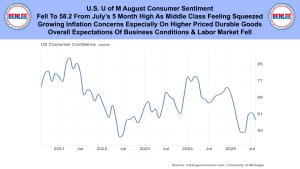

U.S. August U of M Consumer sentiment fell to 58.2 from July’s 5 month high as the middle class is feeling squeezed. There were growing inflation concerns especially on higher priced durable goods. Overall expectations of business conditions and the labor market fell.

U.S. July personal spending increased .5% vs June, the sharpest increase in 4 months as durable goods and services rose. Consumers are buying more as tariff driven prices are expected to rise.

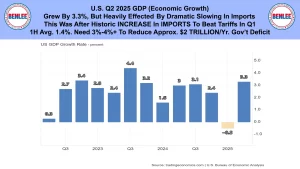

U.S. Q2 2025 GDP which is economic growth. The economy grew by a solid 3.3%, but was heavily affected by the dramatic slowing of imports. This was after the historic increase in imports to beat tariffs that happened in Q1. See the previous chart. 1H average was a slow 1.4%. We need 3%-4% or more growth to reduce the approximate $2.0 trillion dollar per year government deficit.

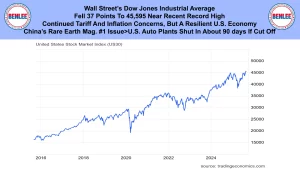

Wall Street’s Dow Jones Industrial Average fell 37 points to 45,595 near the recent record high. This was on continued tariff and inflation concerns, but a resilient U.S. economy. China’s rare earth magnets are by far the #1 issue that is not understood by most. Every U.S. auto plant will shut in about 90 days if the Chinese cut off the supply.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.