August 4, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, August 4th, 2025.

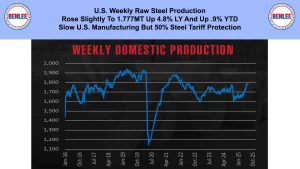

U.S. weekly raw steel production rose slightly to 1.777MT up 4.8% from last year and up .9% year to date. This was on slow U.S. manufacturing, but 50% steel tariff protection.

WTI crude oil price rose to $67.28/b. as OPEC+ finalized a production increase yesterday of 547Kb/d starting in September. The U.S. may implement sanctions on Russian oil which will drive up the price.

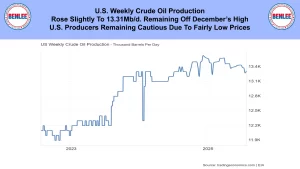

U.S. weekly crude oil production rose slightly to 13.31Mb/d. remaining off December’s high. U.S. producers are remaining cautious due to fairly low prices.

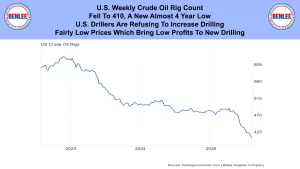

The U.S. weekly crude oil rig count fell to 410 a new almost 4 year low. U.S. drillers are refusing to increase drilling because fairly low prices bring low profits to new drilling.

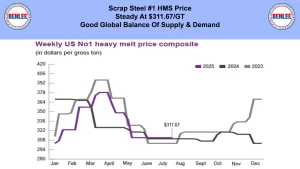

Scrap steel #1 HMS price was steady at $311.67/GT on a good global balance of supply and demand.

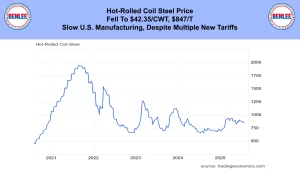

Hot-Rolled Coil Steel Price fell to $42.35/cwt, which is $847/T on slow U.S manufacturing despite multiple new tariffs.

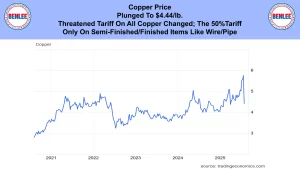

Copper price plunged to $4.44/lb., as the threated tariffs on all copper changed. Now the 50% tariff is only on semi-finished and finished items like wire and pipe.

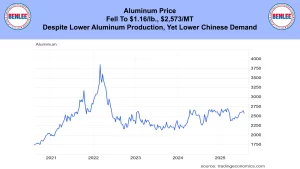

Aluminum price fell to $1.16/lb., $2,573/T despite lower aluminum production, yet lower Chinese demand.

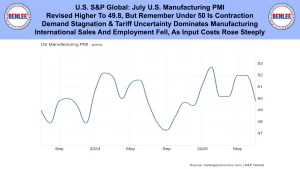

U.S. S&P Global July U.S. Manufacturing PMI was revised higher to 49.8, but under 50 is contraction. This was as demand stagnation and tariff uncertainty dominates manufacturing. International sales and employment fell as input costs rose steeply.

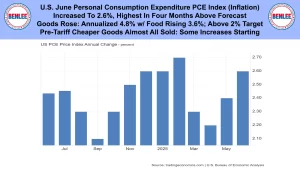

U.S. June personal consumption expenditure PCE index which is a key inflation measure. It increased to 2.6% the highest point in four months and above forecast. Goods rose an annualized 4.8% with food rising 3.6%, which are above the 2% target. Pre-tariff cheaper goods are almost all sold so some increases are starting.

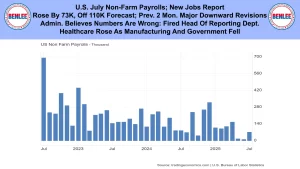

U.S. July non-farm payrolls, the new jobs report. It rose by 73,000 off the 110,000 forecast and the previous 2 months had major downward revisions. The Administration believes the numbers are wrong so they fired the head of the reporting department. Healthcare rose as manufacturing and government fell.

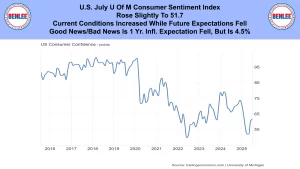

U.S. July U of M consumer sentiment index rose slightly to 51.7. Current conditions increased while future expectations fell. Good news/bad news is that the 1 year inflation expectation fell, but is 4.5%.

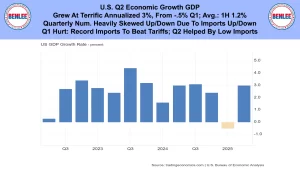

U.S. Q2 Economic growth, GDP grew at a terrific annualized 3% from -.5% in Q1, making the average 1H 1.2%. The quarterly numbers were heavily skewed up and down due to imports being up and down. Q1 was hurt due to record imports to beat tariffs. Q2 was helped by low imports.

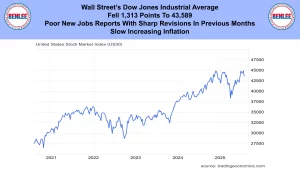

Wall Street’s Dow Jones Industrial Average fell 1,313 points to 43,589, due to the poor jobs report with the sharp previous months downward revision and the slow increasing inflation.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.