July 28, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, July 28th, 2025.

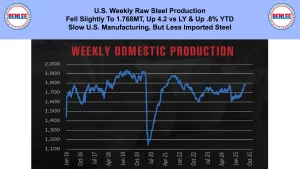

U.S. weekly raw steel production fell slightly to 1.768MT up 4.2% vs last year and up .8% YTD. This was on slow U.S. manufacturing but less imported steel.

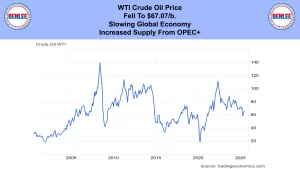

WTI crude oil price fell to $67.07/b., on a slowing global economy and increased supply from OPEC+.

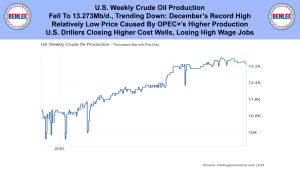

U.S. weekly crude oil production fell to 13.273Mb/d., which is trending down from December’s record high. The relatively low price caused by OPEC+’s higher production has U.S. drillers closing higher cost wells, so we are losing high wage jobs.

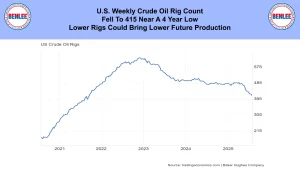

The U.S. weekly crude oil rig count fell to 415 near a 4 year low. Lower rigs could bring lower future production.

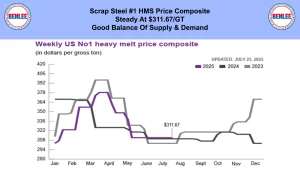

Scrap steel #1 HMS price was steady at $311.67/GT. This was on a good balance of supply and demand.

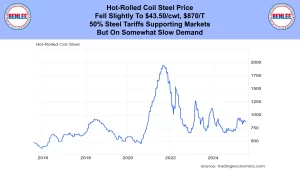

Hot-Rolled Coil Steel Price fell slightly to $43.50/cwt., $870/T. This was on the 50% steel tariffs supporting markets, but on somewhat slow demand.

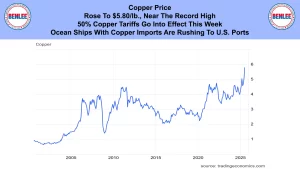

Copper price rose to $5.80/lb., near the record high. The 50% copper tariffs go into effect this week as ocean ships with copper imports are rushing to U.S. ports.

Aluminum price rose slightly to $1.20/lb., $2,635/MT the highest in 4 months. This was on lower supply, tariffs and higher Chinese and European demand.

U.S. June sales of new single family homes rose .6% to 627,000 annualized, but below the rate of the 1960s, 60 years ago. High home prices and high mortgage rates are hurting sales.

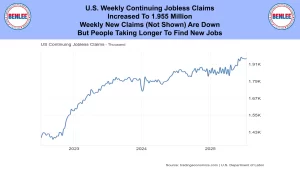

U.S. weekly continuing jobless claims increased to 1.955 million. Weekly claims which are not shown here are down, but people are taking longer to find new jobs.

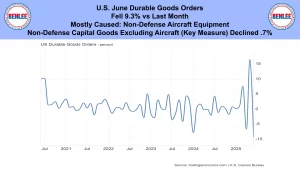

U.S. June durable goods orders fell 9.3% vs last month mostly caused by non-defense aircraft equipment. Non-defense capital goods, excluding aircraft, which is a key measure not shown, declined .7%.

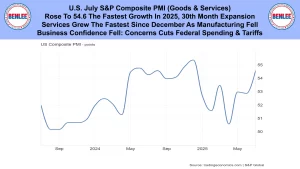

U.S. July S&P composite PMI which is goods and services. It rose to 54.6 the fastest growth in 2025 and it is the 30th month of expansion. Services grew the fastest since December, as manufacturing fell. Also, business confidence fell on concerns over cuts in federal spending and tariffs.

The U.S. the European Union announced a trade deal yesterday. Many items into the U.S. will rise to a 15% tariff. Tariffs are now about $400B/year, which will help the about $2.3T/year U.S. Government deficit.

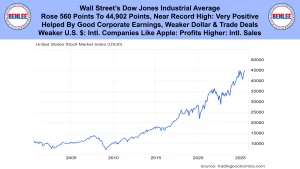

Wall Street’s Dow Jones Industrial Average rose 560 points to 44,902 near the record high, which is very positive. It was helped by good corporate earnings, the weaker dollar and trade deals. The weaker U.S. dollar has international companies like Apple have higher profits on international sales.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.