July 14, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, July 14th, 2025.

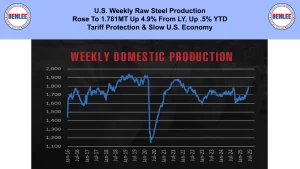

U.S. weekly raw steel production rose to 1.781MT up 4.9% from last year and up .5% year to date. This was on tariff protection and the slow U.S. economy.

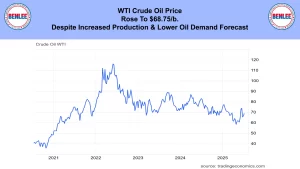

WTI crude oil price rose to $68.75/b., despite increased production and a lower oil demand forecast.

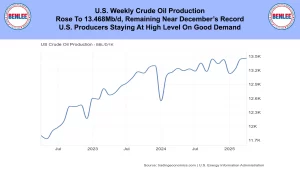

U.S. weekly crude oil production rose to 13.468Mb/d., remaining near December’s record. U.S. producers are staying at a high level on good demand.

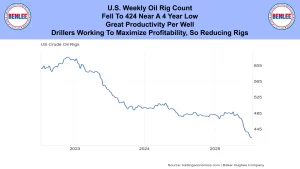

The U.S. weekly crude oil rig count fell to 424, near a 4-year low. This was on great productivity per well as drillers are working to maximize profitability, so they are reducing rigs.

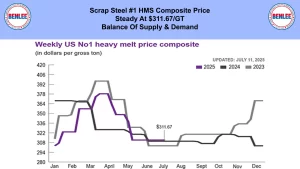

Scrap steel #1 HMS price composite was steady at $311.67/GT on a balance of supply and demand.

Hot-Rolled Coil Steel Price fell To $43.85cwt, which is $877/T on slowing U.S. demand, but high tariffs.

Copper weekly price soared to $5.58/lb. on the new 50% copper tariff. The U.S. imports about half the copper that we use.

Aluminum weekly price rose slightly to $1.18/lb., $2,604/MT on lower supply, but lower demand.

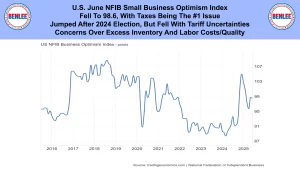

U.S. June NFIB small business optimism index fell to 98.6 with taxes being the #1 issue. It jumped after the 2024 election, but fell with tariff uncertainties. There are now concerns over excess inventory and labor costs and quality.

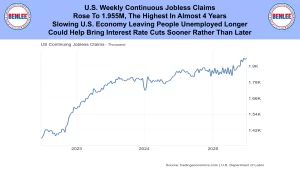

U.S. weekly continuous jobless claims rose to 1.955M, the highest in almost 4 years. The slowing economy is leaving people unemployed longer. This slowing could help bring interest rate cuts sooner rather than later.

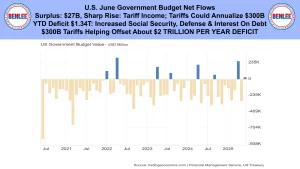

U.S. June government budget net flows. There was a surplus of $27B on the sharp rise in tariff income that could annualize to $300B per year. Year to date the U.S. budget deficit is $1.34T, yes trillion on increased social security, defense, and interest on the debt. The $300B of tariffs is helping offset the about $2 Trillion per year, yes $2 Trillion per year U.S. federal budget deficit.

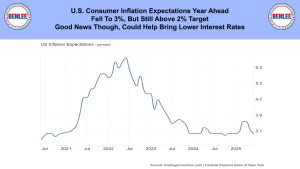

U.S. consumer inflation expectations for the year ahead, fell to 3%, but is still above the 2% target. Good news though. This could help bring lower interest rates as discussed.

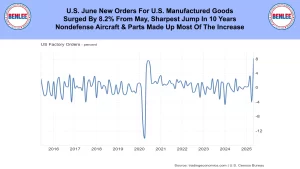

U.S. June new orders for U.S. manufactured goods surged by 8.2% from May, the sharpest jump in 10 years. Nondefense aircraft and parts made up most of the increase.

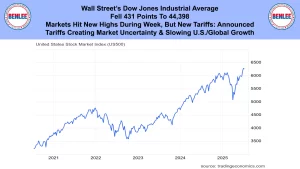

Wall Street’s Dow Jones Industrial Average fell 431 points to 44,398. Markets hit new highs during the week, but new tariffs were announced. Tariffs are creating market uncertainty and slowing U.S. and global growth.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.