June 16, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, June 16th, 2025.

U.S. weekly raw steel production rose to 1.785MT up 4.8% from last year, but down .2% year to date. Steel production continues rising due to the 50% tariff protection.

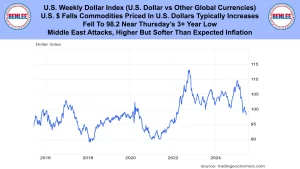

U.S. Weekly dollar index, which is the U.S. Dollar vs other global currencies. When the U.S. dollar falls, commodities priced in dollars typically increases. It fell to 98.2 near Thursday’s 3+ year low. This on the Middle East attacks and on higher, but softer than expected inflation.

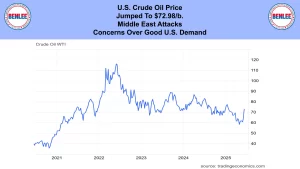

WTI crude oil price jumped to $72.98/b., on the Middle East attacks and on concerns over good U.S. demand.

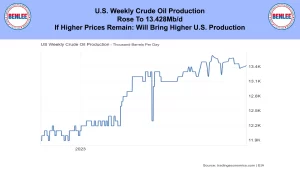

U.S. weekly crude oil production rose to 13.428Mb/d. If higher prices remain it will bring higher U.S. production.

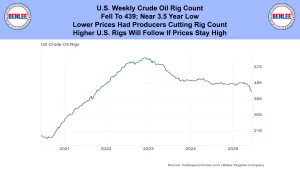

The U.S. weekly crude oil rig count fell to 439 near a 3.5 year low. Lower prices had producers cutting the rig count. Higher U.S. rigs will follow if prices stay high.

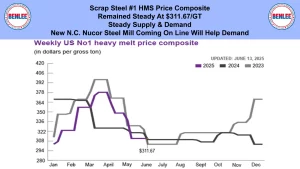

Scrap steel #1 HMS price composite was steady at $311.67/GT on steady supply and demand. The new North Carolina Nucor steel mill coming online will help demand.

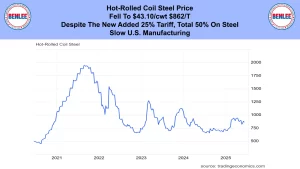

Hot-rolled coil steel price fell to $43.10/cwt., $862/T despite the new added 25% tariff, now a total of 50% on steel. Also on slow U.S. manufacturing.

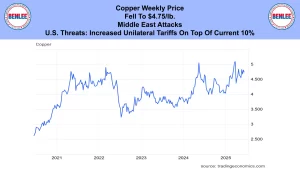

Copper weekly price fell to $4.75/lb., on the Middle East attacks and on U.S. threats of increased unilateral tariffs on top of the current 10%.

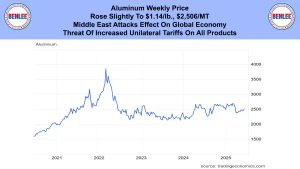

Aluminum weekly price rose slightly to $1.14/lb., $2,506/MT on the Middle East attacks effect on the global economy. Also, on the threats of the increased unilateral tariffs on all products we just talked about.

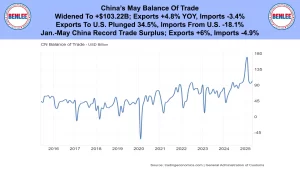

China’s May balance of trade widened to a positive $103.22B as exports increased 4.8% year over year and imports fell 3.4%. Exports to the U.S. plunged 34.5% as imports from the U.S. fell 18.1%. In January through May China had a record surplus as exports rose 6% and imports fell 4.9%.

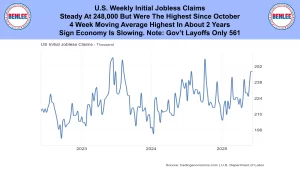

U.S. weekly initial jobless claims were steady at 248,000, but were the highest since October. The 4 week moving average was the highest in about 2 years. This is a sign the economy is slowing. Note that government layoffs were only 561.

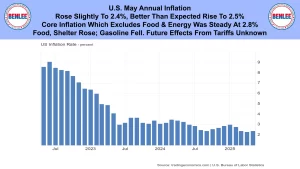

U.S. annual inflation rose slightly to 2.4%, better than the expected rise to 2.5%. Core inflation that excludes food and energy was steady at 2.8%. Food and shelter rose, as gasoline fell. Future effects from tariffs are unknown.

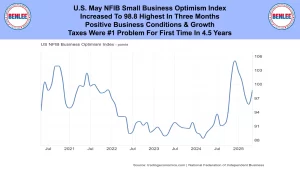

U.S. May NFIB small business optimism index increased to 98.8 the highest in three months. This was on positive business conditions and growth. Taxes were noted as the #1 issue for the first time in 4.5 years.

U.S. University of Michigan consumer confidence survey rose to 60.5 from near a record low of 52.2 in May and April. This was the first rise in 6 months as current and future expectations rose. The economy and tariffs remain concerns as inflation expectations improved.

Wall Street’s Dow Jones Industrial Average fell 585 points to 42,198. This was on the Middle East attacks and the oil price surge that acts like a tax. Airline and technology shares fell as defense and oil stocks rose.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.