May 5, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, May 5th, 2025.

U.S. weekly raw steel production rose to 1.706MT, up .6% from LY, but down 1.2% YTD. Steel tariffs are only partly helping U.S. steel production, but Cleveland Cliffs is idling three operations due to a lack of demand.

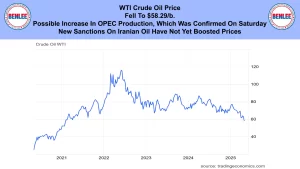

WTI crude oil price fell to $58.29/b. on possible increases in OPEC production which was confirmed on Saturday. New sanctions on Iranian oil have not yet boost prices.

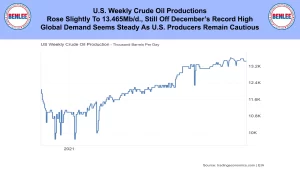

U.S. weekly crude oil production rose slightly to 13.465Mb/d., still off December’s record high. Global demand seems steady as U.S. producers remain cautious.

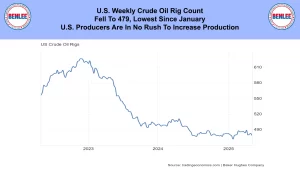

The U.S. weekly crude oil rig count fell to 479, the lowest since January. U.S. producers are in no rush to increase production.

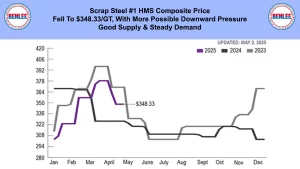

Scrap steel #1 HMS composite price fell to $348.33/GT with more possible downward pressure on a good supply and steady demand.

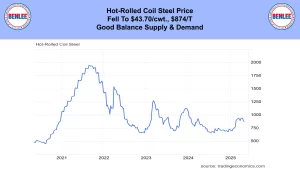

Hot-rolled coil steel price fell to $43.70/cwt., which is $874/T on a good balance of supply and demand.

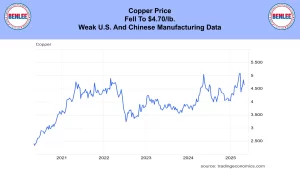

Copper price fell to $4.70/lb., on weak U.S. and Chinese manufacturing data.

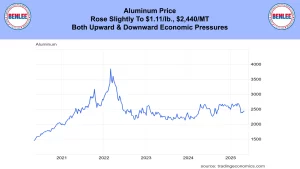

Aluminum price rose slightly to $1.11/lb., $2,440/MT on both upward and downward economic pressure.

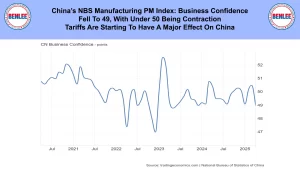

China’s NBS manufacturing PM index, which is business confidence fell to 49, with under 50 being contraction. Tariffs are starting to have a major effect on China.

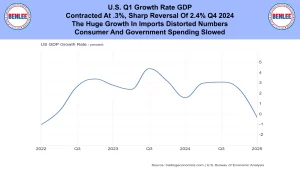

U.S. Q1 growth rate, which is GDP contracted at .3% a sharp reversal of the 2.4% Q4 2024 rate. The huge growth in imports distorted numbers, as consumer and government spending slowed.

U.S. ISM manufacturing PMI business confidence slipped to 48.7, with under 50 being contraction. Export orders fell due to tariffs as rising costs hurt. It remains interesting that it also fell months after the 2018 tax cut.

U.S. March goods trade deficit widened sharply to $162B a new record high. U.S. importers raced to beat tariffs.

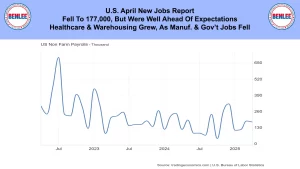

U.S. April new jobs report fell to 177,000 but were well ahead of expectations. Healthcare and warehousing grew as manufacturing and government jobs fell.

Wall Street’s Dow Jones Industrial Average rose 1,203 points to 41,317 on the strong jobs data on possible trade talks with China. China’s exports are down. The largest port in the U.S. is Los Angeles where the volume drop is expected to be 35% next week, which will hurt the U.S. economy.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.