May 27, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, May 27th, 2025.

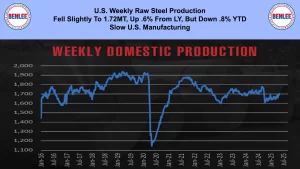

U.S. weekly raw steel production fell slightly to 1.72MT up .6% from last year, but down .8% year to date. This was on slow U.S. manufacturing

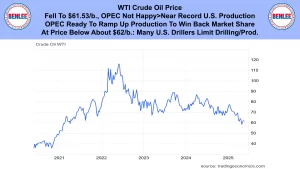

WTI crude oil price fell to $61.53/b. OPEC is not happy about near record U.S. production. OPEC is ready to ramp up production to win back market share. A price below about $62/b, many U.S. drillers limit drilling and production.

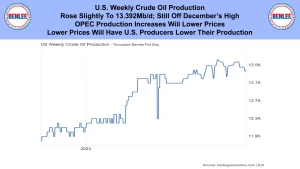

U.S. weekly crude oil production rose slightly to 13.392Mb/d., still off Decembers high. OPEC production increases will lower prices. Lower prices will have U.S. producers lower production.

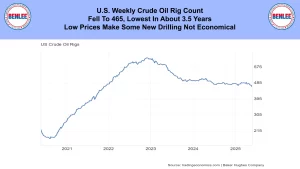

The U.S. weekly crude oil rig count fell to 465 the lowest in about 3.5 years. Low prices many some new drilling not economical.

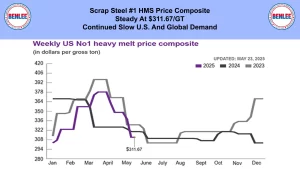

Scrap steel #1 HMS price composite was steady at $311.33/GT on continued slow U.S. and global demand.

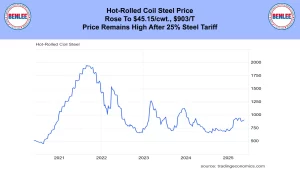

Hot-rolled coil steel price rose to $45.15/cwt. $870/T. The price remains high after the 25% steel tariff.

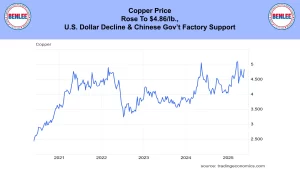

Copper price rose to $4.86/lb., on the U.S. Dollar decline and on Chinese government factory support.

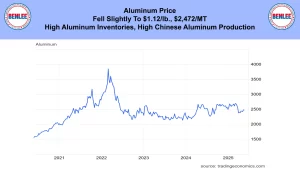

Aluminum price fell slightly to $1.12/lb., $2,472/MT on high inventories and high Chinese aluminum production.

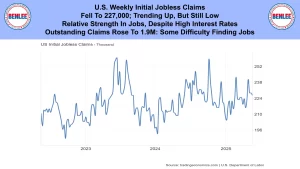

U.S. weekly initial jobless claims fell to 227,000 which is trending up, but still low. There is a relative strength in jobs despite high interest rates. Outstanding claims rose to 1.9M, showing there is some difficulty in finding jobs.

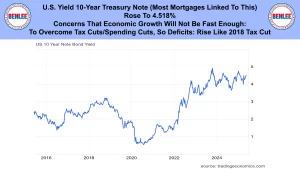

U.S. yield on 10-year treasury note. Most mortgages are linked to this. It rose to 4.518%. This was on concerns that economic growth will not be fast enough to overcome tax cuts, so deficits could rise like after the 2018 tax cut.

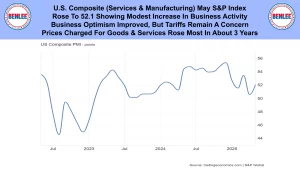

U.S. composite and in services and manufacturing May S&P index. It rose to 52.1 showing modest increase in business activity. Business optimism improved, but tariffs remain a concern. Prices charged for goods and services rose the most in about 3 years.

U.S. April sales single family homes surged to 743,000 the highest in over two years. This was as there were builder incentive to offset the increase in mortgages.

U.S. May S&P flash purchasing managers’ index increase to 52.3 the highest in three months. Factory production increased as selling prices were higher, but the increase in inventories drove the index the most.

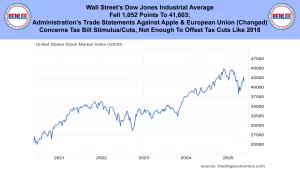

Wall Street’s Dow Jones Industrial Average fell to 1,052 points to 41,603. This was in trade statements against Apple and the European Union. On Sunday the Administration temporary backed off on the European Union threats. Also, it is concerns that the new tax bill stimulus and cuts are not enough to offset tax cuts and will drive up deficits, like in 2018.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.