May 12, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, May 12th, 2025.

U.S. weekly raw steel production fell slightly to 1.701MT, up 1.4% from last year and down 1.0% year to date. This was despite tariffs and a slowing economy. Cleveland Cliffs, a top 5 U.S. steel company announced more layoffs and closings.

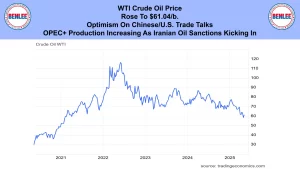

WTI crude oil price rose to $61.04/b., on optimism of Chinese/U.S. trade talks. Also, OPEC+ production has been increasing as Iranian oil sanctions are kicking in.

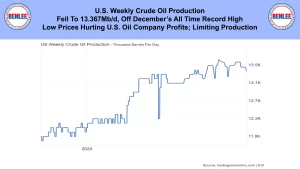

U.S. weekly crude oil production fell to 13.367Mb/d, off December’s all time record. Low prices are hurting U.S. oil company profits which is limiting production.

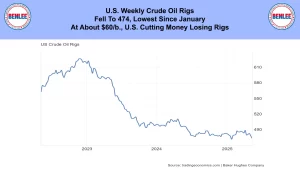

The U.S. weekly crude oil rig count fell to 474 the lowest since January. At about $60/b. the U.S. is cutting money losing rigs.

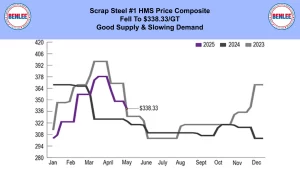

Scrap steel #1 HMS price composite fell to $338.33/GT. This was on good supply and slowing global demand.

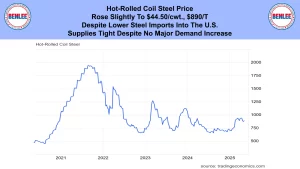

Hot-rolled coil steel price rose slightly to $44.50/cwt, which is $890/T. This was despite lower steel imports into the U.S. Supplies are tight despite no major demand increase.

Copper price fell to $4.65/lb., on weaker global demand and oversupply concerns.

Aluminum price fell to $1.10/lb., $2,421/MT on good supply and slow demand concerns.

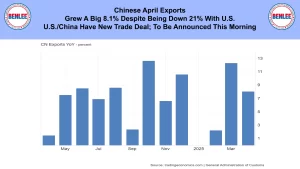

Chinese April exports grew a big 8.1% despite being down 21% with the U.S. The U.S. and China have a new trade deal that is to be announced this morning.

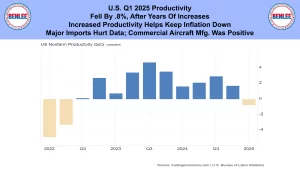

U.S. Q1 2025 productivity fell by .8% after years of increases. Increased productivity helps keep inflation down. Major imports hurt the data. Commercial aircraft manufacturing was a positive.

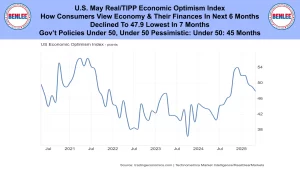

U.S. May Real Clear TIPP Economic optimism index, which is how consumers view the economy and their finances over the next 6 months. It declined to 47.9 the lowest in 7 months. Government policies are under 50 with under 50 being pessimistic. It has been under 50 for 45 months.

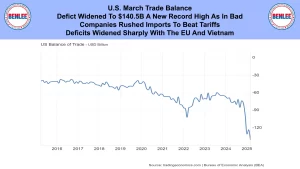

U.S. March Balance of trade. The deficit widened to $140.5B a new record high as in record bad. Companies rushed imports to beat tariffs. Deficits widened sharply with the European Union and Vietnam.

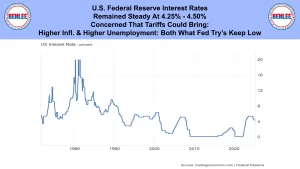

U.S. Federal Reserve interest rates remained at 4.25-4.5%. They said they are concerned that tariffs could bring higher inflation and higher unemployment, both are what they try to keep low.

Wall Street’s Dow Jones Industrial Average fell 68 points to 41,249. A China/U.S. trade deal is to announced this morning.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.