December 23, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, December 23rd, 2024.

U.S. weekly raw steel production fell slightly to 1.65MT down 3.2% from last year and down 2.3% year to date. This was on slow U.S. manufacturing partly due to strong U.S. imports of finished goods.

WTI crude oil price fell to $69.46/b., on the lower U.S. dollar. Also, on new lower global oil consumption forecasts as good supply hurt prices. 50% of China’s new vehicle sale are electric or hybrid, which is hurting global oil demand.

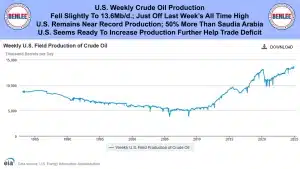

U.S. weekly crude oil production fell slightly to 13.6Mb/d, just off last week’s all-time high. The U.S. remains at near record production, 50% more than Saudi Arabia. The U.S. seems ready to increase production further to help the trade deficit.

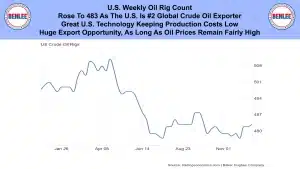

The U.S. weekly oil rig count rose to 483 as the U.S. is the #2 global crude oil exporter. Great U.S. technology is keeping production costs low. There is a huge export opportunity as long as oil prices remain fairly high.

Scrap steel #1 HMS composite price was steady at $303.33/GT. The price remains at a multi-year low on slow global demand and the high U.S. dollar that hurts scrap exports. Also, the multi-year low price is not good for recyclers.

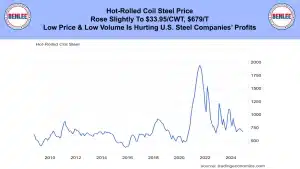

Hot-rolled coil steel price rose slightly to $33.95/CWT, which is $679/T. The low price and low volume is hurting U.S. steel companies’ profits.

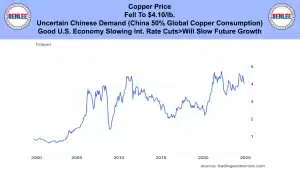

Copper price fell to $4.10/lb., on uncertain Chinese demand. Remember China is 50% of global copper consumption. Also, the good U.S. economy is slowing interest rate cuts, which will slow future growth.

Aluminum price fell to $1.15/lb., $2,543/MT on slow global growth and the strong U.S. Dollar.

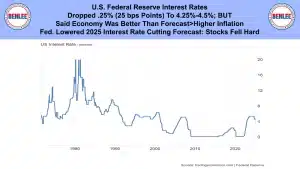

U.S. Federal Reserve interest rates dropped .25% which is 25 basis points to 4.25%-4.5%, but the Federal Reserve said the economy was better than forecast, which is bringing higher inflation. The Federal Reserve then said it lowered their 2025 interest rate cutting forecast. The stock market then fell hard.

U.S. December U of M consumer expectations was revised higher to 73.3. The trend remains up on record employment, record salaries and record spending.

U.S. November home building permits soared to 1.5M annualized. Multi-family grew the most and the most growth was in the Midwest. This was driven by lower interest rates and record amounts of incomes.

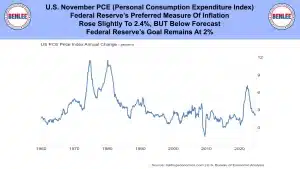

U.S. November PCE, Personal consumption expenditure index, the Federal Reserve’s preferred measure of inflation. It rose slightly to 2.4%, but below forecast. The Federal Reserve’s goal remains at 2%.

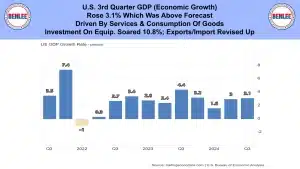

U.S. 3rd quarter GDP. Economic growth rose to 3.1%, which was above forecast. This was driven by services and consumption of goods. Also, investment on equipment soared 10.8% and exports and imports were revised up.

Wall Street’s Dow Jones Industrial Average fell 988 points to 42,840. The slower interest rate cut forecast hurt stock prices, but lower inflation vs forecast helped Friday’s gains.

This is Greg Brown reporting. As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.