December 22, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, December 22nd, 2025, produced by BENLEE Roll off trailers to support our customers, suppliers, and partners.

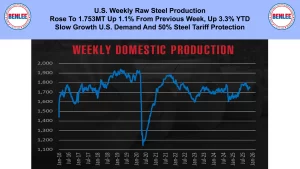

U.S. weekly raw steel production rose to 1.753MT up 1.1% from the previous week and up 3.3% year to date. This was on slow growth U.S. demand and 50% steel tariff protection.

WTI weekly crude oil price fell to $56.52/b., near about a 5 year low. This was on market instability due to Ukraine and Venezuela issues. Also, EVs causing weak Chinese demand with good global production.

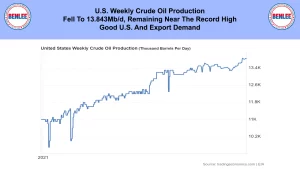

U.S. weekly crude oil production fell to 13.843Mb/d., remaining near the record high on good U.S. and export demand.

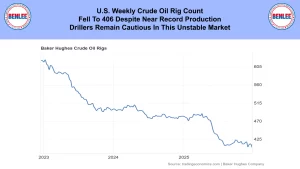

The U.S. weekly crude oil rig count fell to 406 despite near record production. Drillers remain cautious in this unstable market.

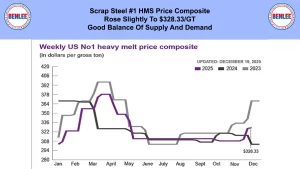

Scrap steel #1 HMS price composite rose slightly to $328.33/GT on a good balance of supply and demand.

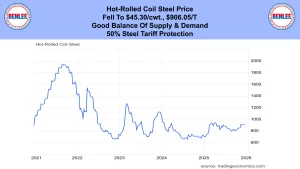

Hot-Rolled coil steel price fell to $45.30/cwt. which is $906.05/T. This was on a good balance of supply and demand and the 50% steel tariff protection.

Copper price rose to $5.48/lb. on good demand in the U.S. for data centers as electric vehicle sales are slowing. Also, on record demand in China for Electric vehicles. China is now the #1 global manufacturer of electric vehicles.

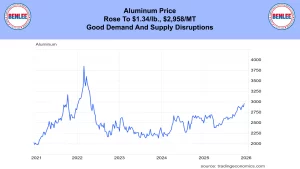

Aluminum price rose to $1.34/lb., which is $2,958/MT on good demand and supply disruptions.

U.S. December U of M consumer sentiment was revised lower to 52.9 near the lowest point in 70 years. High prices, inflation, and jobs remain issues. Near record stock prices and near record home equity is helping many, but not all.

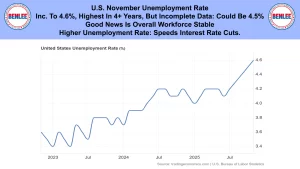

U.S. November unemployment rate increased to 4.6% the highest in over 4 years, but incomplete data due to the shutdown could mean actually about 4.5%. Good news is the overall workforce is stable. The higher unemployment rate speeds interest rate cuts.

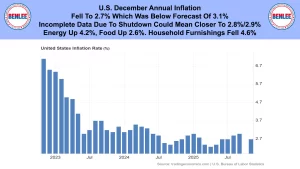

U.S. December annual inflation fell to 2.7% which was below the forecast of 3.1%. Incomplete data due to the shutdown could mean it is closer to 2.8% to 2.9%. Energy was up 4.2%, Food up 2.6% as household furnishings fell 4.6%.

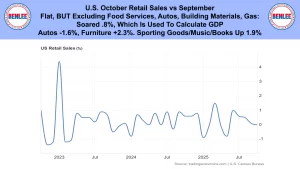

U.S. October retail sales vs September, was flat, but excluding food services, autos, building materials and gasoline, it soared .8%, which is used to calculate GDP. Autos fell 1.6%, furniture rose 2.3% and sporting goods, music and books rose 1.9%.

U.S. November existing home sales rose to 4.13M annualized the highest in 9 months, which is great news. But it is only the level of 1978 47 years ago. This was on slightly lower interest rates as home prices are up only 1.2% year over year.

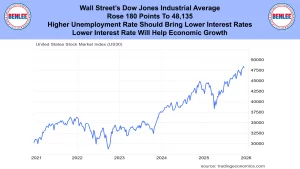

Wall Street’s Dow Jones Industrial Average rose 180 points to 48,135. Higher unemployment rate should bring lower interest rates. Lower interest rates will help economic growth.

This report is brought to you by BENLEE Roll-off trailers, Roll off trucks, Gondola Trailers, Lugger Trucks, Roll-off trailer parts, Roll-off truck parts and dump truck and trailer parts. This is Greg Brown reporting.

Next week is the one week per year we take off, so see you next year. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.