December 15, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, December 15th, 2025, produced by BENLEE Roll off trailers to support our customers, suppliers, and partners.

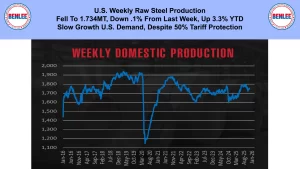

U.S. weekly raw steel production fell to 1.734MT down .1% from last week and up 3.3% year to date. This was on slow growth U.S. demand, despite the 50% steel tariff protection.

WTI crude oil price fell to $57.30/b. on global oversupply as China moves quickly to Electric vehicles. China is the world’s #2 crude oil consumer.

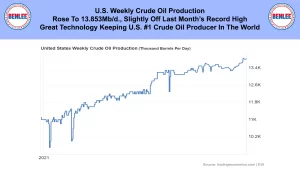

U.S. weekly crude oil production rose to 13.853Mb/d, slightly off last month’s high. Great technology is keeping the U.S. the #1 crude oil producer in the world.

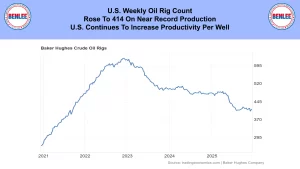

The U.S. weekly crude oil rig count rose to 414 on near record production. The U.S. continues to increase productivity per well.

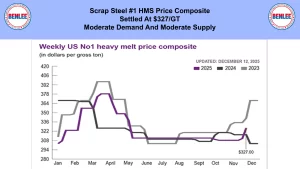

Scrap steel #1 HMS price composite settled at $327/GT on moderate demand and moderate supply.

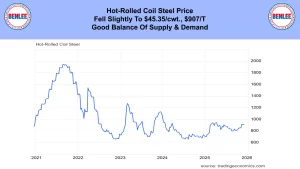

Hot-Rolled coil steel price fell slightly to $45.35/cwt., $907/T on a good balance of supply and demand.

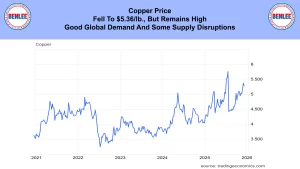

Copper price fell to $5.36/lb., but remains high on good global demand and supply disruptions.

Aluminum price fell to $1.30.lb., $2,877MT on the same good demand and supply concerns.

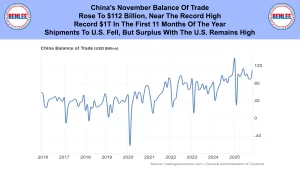

China’s November balance of trade rose to $112B near the record high. It was a record $1T in 11 months as shipments to the U.S. fell but the surplus with the U.S. remains high.

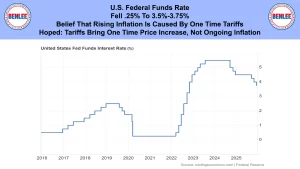

The U.S. Federal Funds rate fell .25% to 3.5%-3.75%. This was on the belief that rising inflation is caused by one time tariffs. It is hoped that tariffs bring a one-time price increase, not ongoing inflation.

The U.S. September trade deficit improved to -$52.8B, the lowest in about 5 years. Note the massive increase in the March 2025 deficit to beat the tariffs. Gold exports rose while pharmaceutical imports also rose.

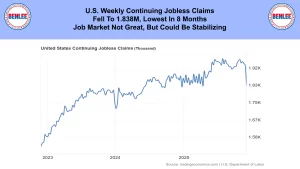

U.S. weekly continuing jobless claims fell to 1.838M the lowest in 8 months. The job market is not great, but could be stabilizing.

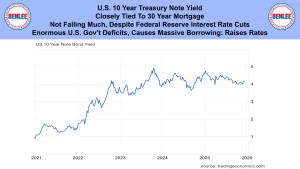

The U.S. 10 year treasury note yield, which is closely tied to 30 year mortgages is not falling much despite the federal reserve interest rate cuts. This is due to enormous U.S. government deficits which causes massive borrowing that raises rates.

Wall Street’s Dow Jones Industrial Average fell 503 points to 47,955 but hit a new record high during the week. Interest rate cuts helped, but there is a belief that tech stocks are overvalued. High stock prices brings the wealth effect, which brings higher consumer spending.

This report is brought to you by BENLEE Roll-off trailers, Roll off trucks, Gondola Trailers, Lugger Trucks, Roll-off trailer parts, Roll-off truck parts and dump truck and trailer parts. This is Greg Brown reporting.

As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.