November 24, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, November 24th, 2025, produced by BENLEE Roll off trailers to support our customers, suppliers, and partners.

U.S. weekly raw steel production fell to 1.745MT down .7% from last week and up 3.2% year to date. There was on slow U.S. demand despite the 50% steel tariff protection.

WTI crude oil price fell to $58.06/b. on over supply concerns. U.S. sanctions on Russian oil are no longer clear will happen as the U.S. published a proposal to give Ukrainian territory to Russia.

U.S. weekly crude oil production fell slightly to 13.834Mb/d. remaining near the record high. The proposed U.S. Ukrainian deal would bring more oil on the market. More oil brings lower prices, which brings lower inflation.

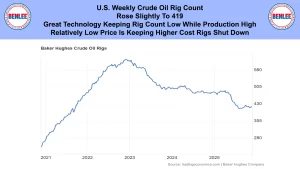

The U.S. weekly crude oil rig count rose slightly to 419. Great technology is keeping the rig count low while production is high. The relatively low price is keeping higher cost rigs shut down.

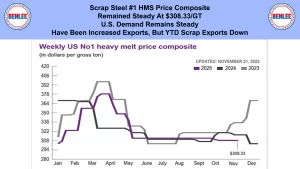

Scrap steel #1 HMS price composite was steady at $308.33/GT as U.S. demand remains steady. There have been some increased exports, but ytd scrap exports are down.

Hot-Rolled coil steel price rose slightly to $42.85/cwt., $857/T. Slow U.S. manufacturing is bringing steady but slow demand.

Copper price fell to $5.00/lb., but remained high. This was on concerns over Chinese and U.S. demand. The global increase in EVs and AI is powering demand.

Aluminum price fell to $1.27/lb., $2,804/MT on overcapacity in China.

U.S. September new jobs rose to 119,000, after August’s 4,000 loss. This was a good number but the trend is down. Healthcare rose the most. Transportation was down the most as manufacturing fell by 6,000.

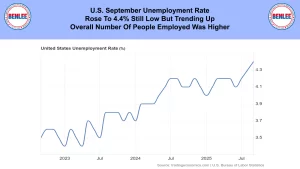

The U.S. September unemployment rate rose to 4.4% which is still low, but trending up, as the number of people employed was higher.

Continuing weekly jobless claims rose to 1.974M, the highest level since 2021. This was as parts of the U.S. economy continue slowing.

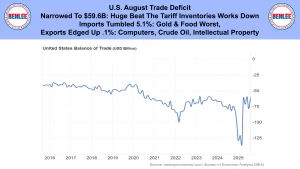

The U.S. August trade deficit narrowed to $59.6B as the huge ‘beat the tariff’ inventory works down. Imports tumbled 5.1% with gold and food the worst. Exports edged up .1% with computers, crude oil and intellectual property led the increase.

U.S. October existing home sales rose to 4.1M annualized the highest in 8 months. Lower mortgage rates are helping sales.

Wall Street’s Dow Jones Industrial Average fell 903 points to 46,245 despite a big rise on Friday. It jumped Friday on hopes of a December interest rate cut. It was down for the week on AI peak concerns. Also, the possible settling of the Ukraine war will hurt massive U.S. arms manufacturing.

This report is brought to you by BENLEE Roll-off trailers, Roll off trucks, Gondola Trailers, Lugger Trucks, Roll-off trailer parts, Roll-off truck parts and dump truck and trailer parts. This is Greg Brown reporting. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.