September 8, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, September 8th, 2025.

U.S. weekly raw steel production fell slightly to 1.77MT, up 2.5% from last year and up 1.4% YTD. This was on a slowing global economy and good supply.

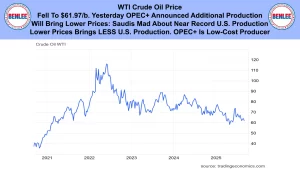

WTI crude oil price fell to $61.97/b. Yesterday, OPEC+ announced additional production which will bring lower prices. The Saudis are mad about the near record U.S. production. Lower prices brings less U.S. production. OPEC+ is the low cost producer.

U.S. weekly crude oil production fell slightly to 13.423Mb/d. If prices fall to about $55/b., U.S. oil companies will cut production. Prices and production will rise if U.S. actions hurt Russian oil sales.

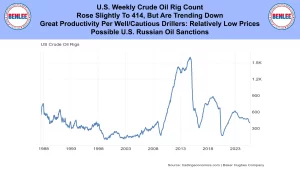

The U.S. weekly crude oil rig count rose slightly to 414, but are trending down. This was on great productivity per well and cautious drillers, due to relatively low prices. Also, on possible U.S. Russian oil sanctions that we mentioned.

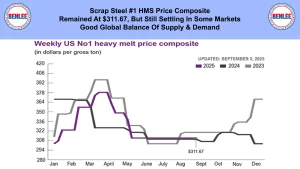

Scrap steel #1 HMS price composite remained at $311.67/GT, but was still settling in some markets. This was on a good balance of supply and demand.

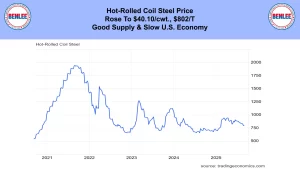

Hot-Rolled coil steel price rose to $40.10/cwt., $802/T on a good supply and the slow U.S. economy.

Copper price fell to $4.54/lb., on the lingering effect of the U.S. removing some copper tariffs as good global demand continues.

Aluminum price fell to $1.18/lb., $2,606/MT on stable demand but supply constraints in Guinea and China.

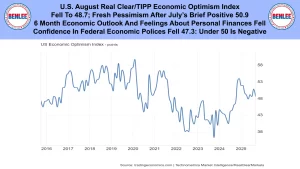

U.S. August Real Clear/TIPP Economic optimism index fell to 48.7 on fresh pessimism after July’s brief positive 50.9. The 6 month economic outlook and feelings about personal finances fell. Confidence in Federal Economic policies fell to 47.3. Remember that under 50 is negative.

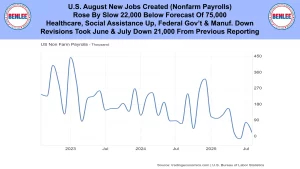

U.S. August new jobs created, which is non-farm payrolls. They rose by a slow 22,000, below the forecast of 75,000. Healthcare and social assistance were up, as Federal Government and manufacturing jobs were down. Revisions took June and July down 21,000 from the previous reporting.

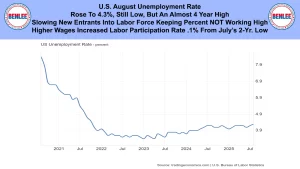

U.S. August unemployment rate rose to 4.3% which is still low, but an almost 4 year high. Slowing new entrants into the labor force is keeping the percent NOT working high. Higher wages increased the labor participation percent by .1% from July’s 2 year low.

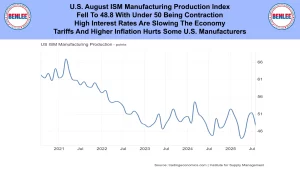

U.S. August ISM manufacturing production index fell to 48.8 with under 50 being contraction. High interest rates are slowing the economy. Tariffs and the higher inflation hurts some U.S. manufacturers.

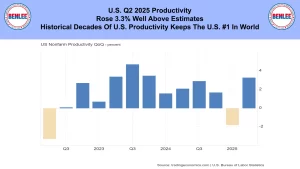

U.S. Q2 2025 productivity rose to 3.3% well above estimates. Historical decades of U.S. productivity keeps the U.S. #1 in the world.

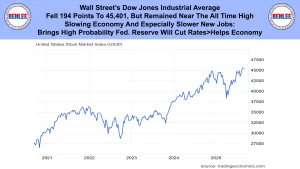

Wall Street’s Dow Jones Industrial Average fell 194 points to 45,401, but remained near the all-time high. The slowing economy and especially slower new jobs brings a high probability the Federal Reserve will cut interest rates which helps the economy.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.