July 21, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, July 21st, 2025.

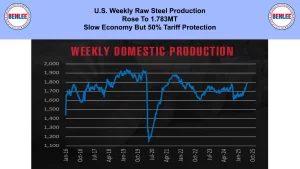

U.S. weekly raw steel production rose to 1.783MT on a slow economy, but 50% tariff protection.

WTI crude oil price fell to $67.30/b., despite concerns over new EU Russian energy exports.

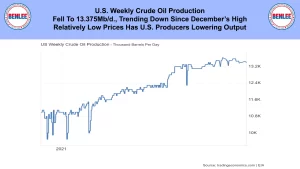

U.S. weekly crude oil production fell to 13.375Mb/d., and have been trending down since December’s high. Relatively low prices has U.S. producers lowering output.

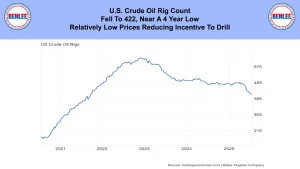

The U.S. weekly crude oil rig count fell to 422 near a 4 year low. Relatively low prices are reducing the incentive to drill.

Scrap steel #1 HMS price composite remained at $311.67/GT. This was on steady demand and good supply.

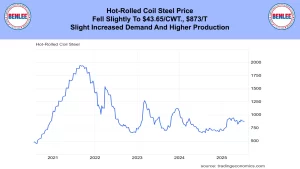

Hot-Rolled Coil Steel Price fell slightly to $43.65/cwt., which is $873/T. This was on slight increased demand and higher production.

Copper price was steady at $5.58/lb. which remains near the record high. August 1st 50% tariffs are still set to happen.

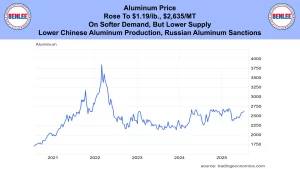

Aluminum price rose to $1.19/lb., which is $2,635/MT on softer demand, but lower supply. There has been lower Chinese production and Russian aluminum sanctions.

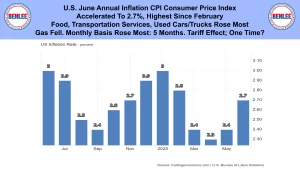

U.S. June annual inflation, called CPI, consumer price index. It accelerated to 2.7% the highest since February. Food, transportation services and used cars and trucks rose the most. Gasoline fell. On a monthly basis it rose the most in 5 months. A question is will the tariff effect be a one-time boost in prices?

U.S. weekly continuing jobless claims rose to 1.956M. Initial jobless claims that are not shown were down, but people are finding it harder to find new jobs.

U.S. NAHB/Wells Fargo housing market index. It tracks the pulse of the single-family housing market. It edged up to 33, but is still low. High home prices and high interest rates has builders cutting prices.

U.S. June Retail sales rose .6% from May. Miscellaneous stores and vehicles rose the most. Furniture and electronics fell.

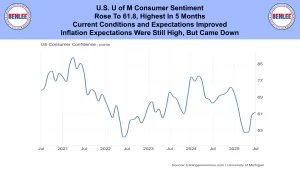

U.S. U of M consumer sentiment rose to 61.8, the highest in 5 months. Current conditions and expectations improved. Inflation expectations were still high, but came down.

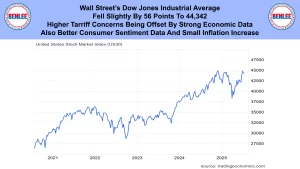

Wall Street’s Dow Jones Industrial Average fell slightly by 56 points to 44,342. This was on high tariff concerns being offset by strong economic data. Also, on better consumer sentiment data and the small inflation increase.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.