July 7, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, July 7th, 2025.

U.S. weekly raw steel production fell slightly to 1.776MT up 4.3% from last year and up .3% YTD. Production has been trending up thanks to the 50% steel tariffs.

U.S. dollar index. The U.S. dollar vs other global currencies. It fell to 97 near a multiyear low on concerns over U.S. trade policy, but also on the good jobs report.

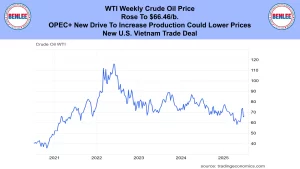

WTI crude oil price rose to $66.46/b. OPEC+’s new drive to increase production could lower prices. Also, this was on the new U.S. Vietnam trade deal.

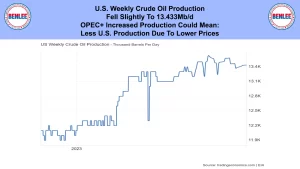

U.S. weekly crude oil production fell slightly to 13.433Mb/d. The OPEC+ increased production could mean less U.S. production, due to lower prices.

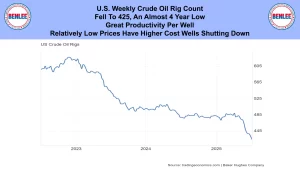

The U.S. weekly crude oil rig count fell to 425 an almost 4 year low. This was on great productivity per well and on relatively low prices have higher cost wells shutting down.

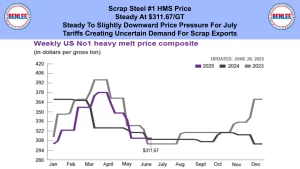

Scrap steel #1 HMS price composite was steady at $311.67/GT. There is steady to downward price pressure for July. Tariffs are creating uncertain demand for scrap exports.

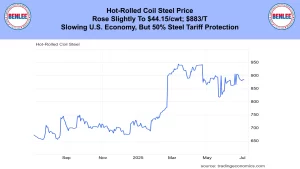

Hot-rolled coil steel price rose slightly to $44.15/cwt; $883/T on the slowing U.S. economy, but the 50% steel tariff protection.

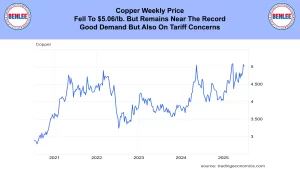

Copper weekly price fell to $5.06/lb. but remains near the record. This was on good demand but also on tariff concerns.

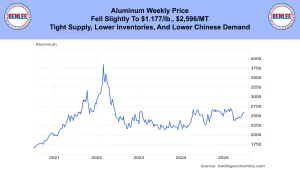

Aluminum weekly price fell slightly to $1.177/lb., $2,596MT on a tight supply, lower inventories, and lower Chinese demand.

There was a new tax and spending bill signed that extends the 2018 tax cuts, but most agree will bring even larger deficits. There are added tax cuts on tips, overtime, seniors, and businesses.

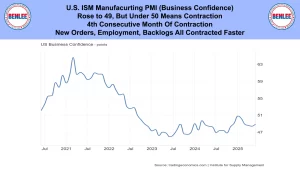

U.S. ISM manufacturing PMI, which is also a gauge of business confidence. It rose to 49, but under 50 means contraction. It was the 4th consecutive month of contraction. New orders, employment, and backlogs all contracted faster.

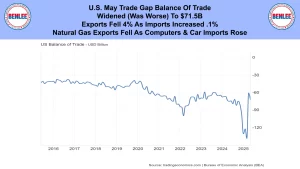

The U.S. May trade gap, balance of trade widened as in was worse to $71.5B. Exports fell 4% as imports increased .1%. Natural gas exports fell as computers and car imports rose.

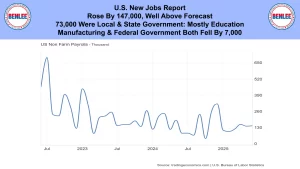

U.S. new jobs report. Jobs rose by 147,000 well above forecast. 73,000 were local and state government, mostly in education. Manufacturing and Federal government jobs both fell by 7,000.

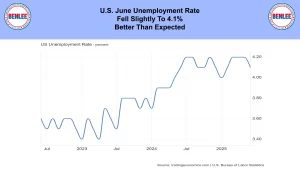

The U.S. June unemployment rate fell slightly to 4.1% better than expected.

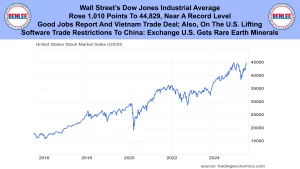

Wall Street’s Dow Jones Industrial Average rose 1,010 points to 44,829, near a record level. This was on the good jobs report and the Vietnam trade deal. Also, on the U.S lifting software trade restrictions to China in exchange for the U.S. getting rare earth minerals.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.