June 30, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, June 30th, 2025.

U.S. weekly raw steel U.S. production rose to 1.787MT up 4.9% from last year and up .2% year to date. The 50% steel tariff remains supporting U.S. steel companies.

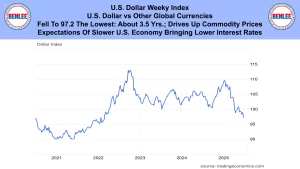

U.S. dollar weekly index. The U.S. dollar vs other global currencies. It fell to 97.2 the lowest point in about 3.5 years, which usually drives up commodity prices. This was on expectations of a slower U.S. economy bringing lower interest rates.

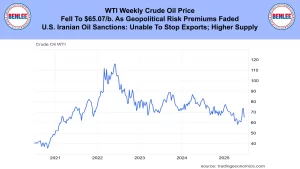

WTI crude oil price fell to $65.07 as geopolitical risk premiums faded. Also, U.S. Iranian oil sanctions were unable to stop their exports so higher global supply.

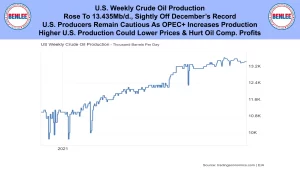

U.S. weekly crude oil production rose to 13.435Mb/d., slightly off December’s record. This was as U.S. producers remain cautious as OPEC+ increases production. Higher U.S. production could lower prices and hurt oil company profits.

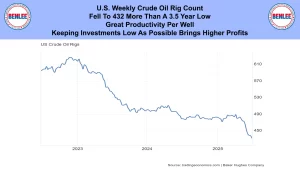

The U.S. weekly crude oil rig count fell to 432 more than a 3.5 year low. This was on great productivity per well and keeping investments as low as possible which brings higher profits.

Scrap steel #1 HMS price composite was steady at $311.67/GT on a balance of supply and demand. Prices for July might remain steady.

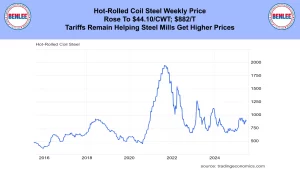

Hot-rolled coil steel price rose to $44.10/CWT, which is $882/T. Tariffs remain helping steel mills get higher prices.

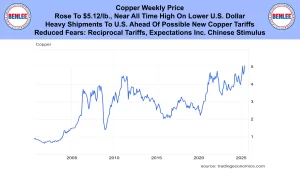

Copper weekly price rose to $5.12/lb., near an all-time high on the lower U.S. dollar and on heavy shipments to the U.S. ahead of possible new tariffs. Also, on reduced fears of reciprocal tariffs and expectations of increased Chinese stimulus.

Aluminum weekly price rose to $1.16/lb., $2,556/MT on stronger than expected Chinese demand. Also, on bauxite supply concerns out of Guinea.

U.S. May home building permits fell 2% to 1.394M annualized. Higher mortgage rates and higher prices are hurting building.

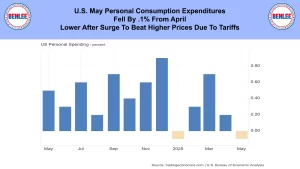

U.S. May personal consumption expenditures fell by .1% from April. It was lower after the surge of spending to beat higher prices due to tariffs.

U.S. May goods trade deficit. It widened as in got worse to $96.5B. Still better than a few months ago on the import rush to beat tariffs.

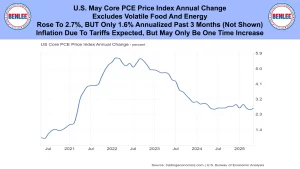

U.S. core PCE price index annual change. This excludes volatile food and energy. It rose 2.7%, but only 1.6% annualized in the past three months. Increased inflation due to tariffs is expected, but may only be a one time increase.

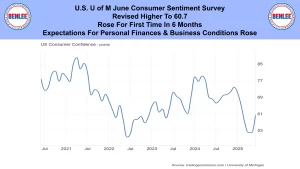

U.S. U of M June consumer sentiment survey was raised higher to 60.7. It rose for the first time in 6 months. Expectations for personal finances and business conditions rose.

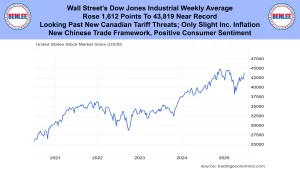

Wall Street’s Dow Jones Industrial Weekly Average rose 1,612 points to 43,819 near the record. Wall street is looking past the new Canadian tariff threats and there was only a slight increase in inflation. Also, on the new Chinese trade framework and positive consumer sentiment we just talked about.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.