June 23, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, June 23rd, 2025.

U.S. weekly raw steel U.S. production fell slightly to 1.783MT up 4.7% from last year and flat year to date. 50% steel tariffs is helping U.S. production.

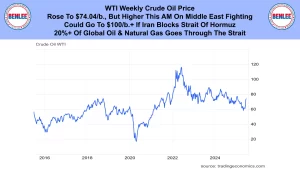

WTI crude oil price rose to $74.04/b, but it will be higher this morning on the Middle East fighting. Oil could go to $100/b or more if Iran blocks the Strait of Hormuz. 20% or more of global oil and gas go through the Strait.

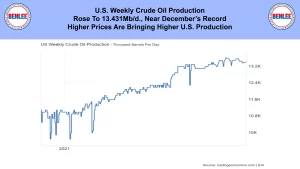

U.S. weekly crude oil production rose to 13.431Mb/d near December’s record. Higher prices are bringing higher U.S. production.

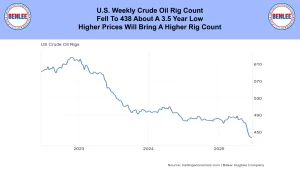

The U.S. weekly crude oil rig count fell to 438 about a 3.5 year low. Higher prices will bring a higher rig count.

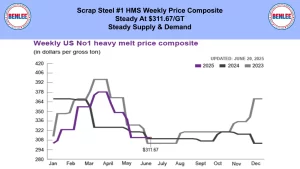

Scrap steel #1 HMS price composite was steady at $311.67/GT on steady supply and demand.

Hot-rolled coil steel price rose to $43.60/cwt., $872/T on continued tariff protection, but a slowing economy.

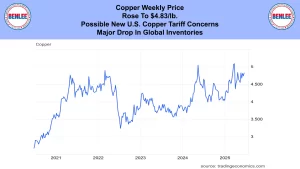

Copper weekly price rose to $4.83/lb. on possible new U.S. copper tariff concerns. Also, on a major drop in global inventories.

Aluminum weekly price rose to $1.16/lb., $2,556/MT on stronger than expected Chinese demand. Also, on bauxite supply concerns out of Guinea.

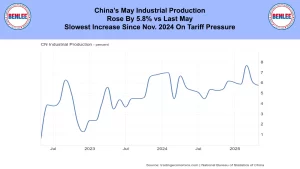

China’s May industrial production rose by 5.8% vs last May. That was the slowest increase since November 2024 on tariff pressure.

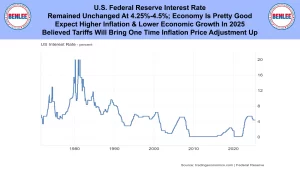

U.S. Federal Reserve interest rate remained unchanged at 4.25-4.5% as they said the economy was pretty good. They also said they expect higher inflation and lower economic growth in 2025. If is believed that tariffs will bring a one-time inflation price adjustment up.

U.S. NAHB Wells Fargo Builders’ market index. This is present and expected sales and traffic on single family homes. It fell to 32, the lowest in 2.5 years. This was on higher housing interest rates and economic uncertainty.

U.S. May retail sales declined .9% from April the largest decrease in 4 months. Motor vehicles fell due to earlier purchases to beat tariffs.

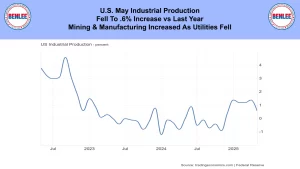

U.S. May industrial production fell to .6% increase vs last year. Mining and manufacturing increased as utilities fell.

U.S. weekly initial jobless claims fell to 245,000 but has been trending up. The labor market is slowing, but it is still good.

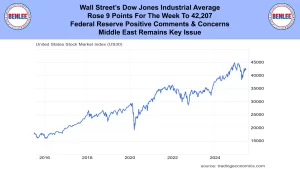

Wall Street’s Dow Jones Industrial Average rose 9 points for the week to 42,207. This was on the Federal Reserve positive comments and concerns. The Middle East remains a key issue.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.