June 9, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, June 9th, 2025.

U.S. weekly raw steel production rose to 1.757MT up 2.8% for the week, but down .5% year to date. Tariffs are having their desired effect of higher U.S. steel production. Higher tariff prices are great for steel company profits, but are inflationary.

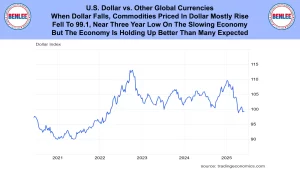

U.S. Dollar vs other global currencies. When the U.S. dollar falls, commodities priced in dollars mostly rise. It fell to 99.1 near a three year low. This was on the slowing U.S. economy, but the economy is holding up better than many expected.

WTI crude oil price rose to $66.58/b. on the weaker U.S. dollar and positive China trade deal talk. The U.S. needs a trade deal due to China’s strangle hold on rare earth minerals. Most U.S. Auto plants will close in about 60 days if we run out of rare earth minerals.

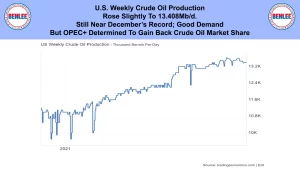

U.S. weekly crude oil production rose slightly to 13.408Mb/d. still near December’s record. This was on good demand, but OPEC+ is determined to gain back crude oil market share.

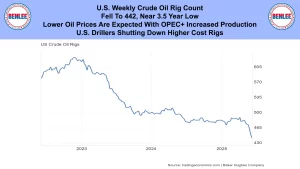

The U.S. weekly crude oil rig count fell to 442 near a 3.5 year low. Lower oil prices are expected with OPEC+ increased production. That has U.S. drillers shutting down higher cost rigs.

Scrap steel #1 HMS price composite was steady at $311.67/GT on a good balance of supply and demand.

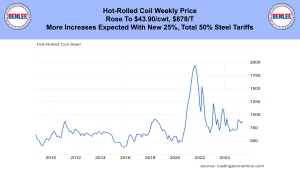

Hot-rolled coil steel price rose $43.90/cwt. $878/T. More increases are expected with the new 25%, now total 50% steel tariffs.

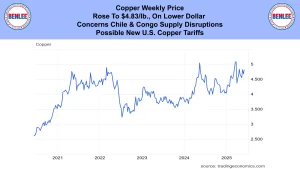

Copper price rose to $4.83/lb., on the lower dollar and concerns over Chile and Congo supply disruptions. Also, on possible new U.S. copper tariffs.

Aluminum price fell to $1.11/lb., $2,446/MT. The new added 25% aluminum tariffs now 50% will distort markets.

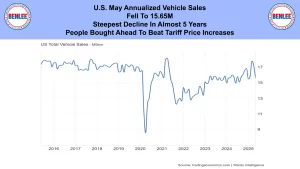

U.S. May annualized vehicle sales fell to 15.65M, the steepest decline in almost 5 years. This was as people bought ahead to beat tariff price increases.

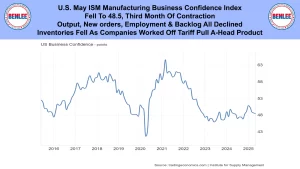

U.S. May ISM manufacturing business confidence index fell to 48.5 the third month of contraction. Output, new orders, employment and backlog all declined. Inventories fell as companies worked off tariff pull ahead product.

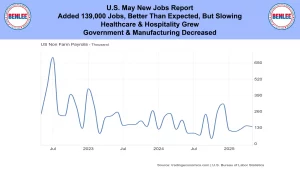

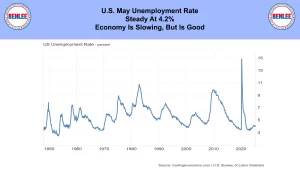

U.S. May new jobs report added 139,000 jobs, better than expected but is slowing. Healthcare and hospitality grew as government and manufacturing decreased.

U.S. May unemployment rate was steady at 4.2%. The economy is slowing, but it is good.

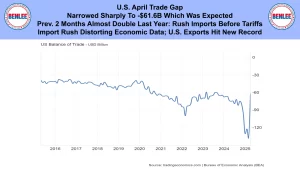

U.S. April trade gap narrowed sharply to -$61.6B which was expected. The previous two months were almost double last year as there was a rush before tariffs hit. The import rush is distorting economic data. On the good side, exports hit a new record.

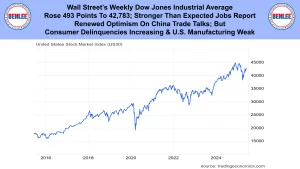

Wall Street’s Dow Jones Industrial Average rose 493 points for the week to 42,783 on the stronger than expected jobs report and renewed optimism on China trade talks. But consumer delinquencies are increasing and U.S. manufacturing is weak

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.