June 2, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, June 2nd, 2025.

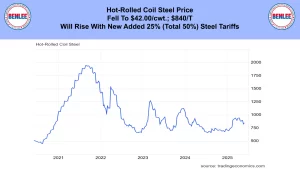

U.S. weekly raw steel production was steady at 1.72MT up .6% from last year, but down .8% year to date. New added 25% steel tariffs, now 50% will increase steel production and steel prices.

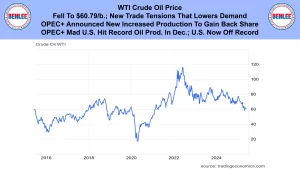

WTI crude oil price fell to $60.79/b., on new trade tensions that lowers demand. Also, OPEC+ announced new increased production to gain back market share. OPEC+ is mad that the U.S. hit record production in December. U.S. production now off the record level.

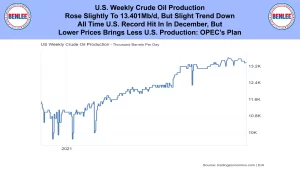

U.S. weekly crude oil production rose slightly to 13.401Mb/d., but there is a slight trend down. The all-time U.S. record was hit in December, but lower prices brings less U.S. production which is OPEC’s plan.

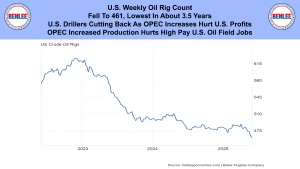

The U.S. weekly crude oil rig count fell to 461 the lowest in about 3.5 years. U.S. drillers are cutting back as OPEC increases hurt U.S. oil company profits. OPEC increased production hurts high pay U.S. oil field jobs.

Scrap steel #1 HMS price composite was steady at $311.67/GT. New added steel tariffs will bring increased steel demand and higher prices as said.

Hot-rolled coil steel price fell to $42.00/cwt., $840/T. Prices will rise with the new added 25%, total 50% steel tariffs.

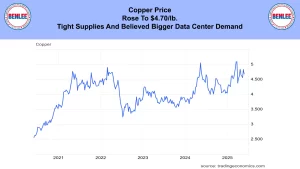

Copper price rose to $4.70/lb., on tight supplies and believed bigger data center demand.

Aluminum price fell to $1.11/lb., $2,446/MT. The new added 25% aluminum tariffs, going to 50% will distort markets.

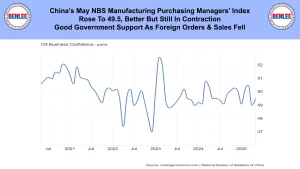

China’s May NBS Manufacturing purchasing managers’ index rose to 49.5 which is better, but still in contraction. This was on good government support as foreign orders and sales fell.

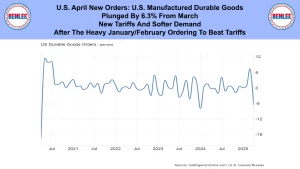

U.S. April new orders for U.S. manufactured durable goods plunged 6.3% from March. This was on new tariffs and soft demand. Also, it went down after the heavy January/February ordering to beat tariffs.

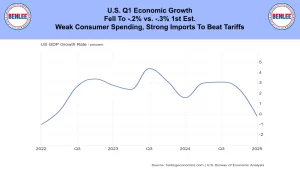

U.S. Q1 Economic growth fell to -.2% vs. -.3% 1st estimate. This was on weak consumer spending and strong imports to beat tariffs.

U.S. May U of M Consumer sentiment was revised higher but sill near 2022 and historic lows. Current economic conditions worsened.

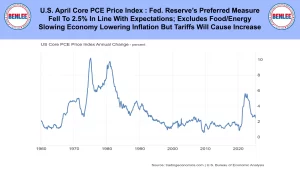

U.S. April Core PCE Price Index the Federal Reserve’s preferred measure of inflation. It fell to 2.5% in line with expectations. Note this excludes volatile food and energy. The slowing economy is lowering inflation, but tariffs will cause an increase.

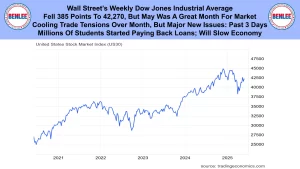

Wall Street’s Dow Jones Industrial Average fell 385 points to 42,270, but May was a great month for the market. This was on cooling trade tensions over the month, but major new issues in the past three days. Also, millions of students started paying back loans which will slow the economy.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.