April 28, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, April 28th, 2025.

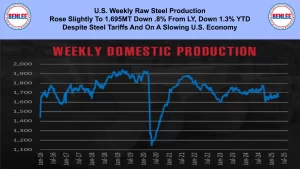

U.S. weekly raw steel production rose slightly to 1.695MT down .8% from last year and down 1.3% YTD. This was despite steel tariffs and on a slowing U.S. economy.

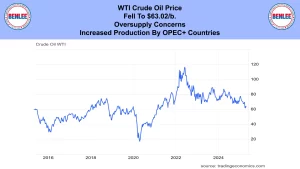

WTI crude oil price fell to $63.02/b., on oversupply concerns due to increased production by OPEC+ countries.

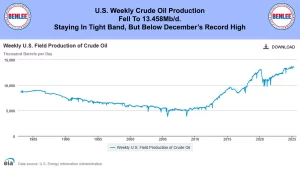

U.S. weekly crude oil production fell to 13.458Mb/d., staying in a tight band, but below December’s record high.

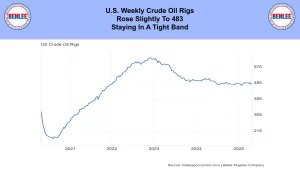

The U.S. weekly crude oil rig count rose slightly to 483, also staying in a tight band.

Scrap steel #1 HMS composite price was steady at $362/GT and is forecast to drop $20/GT or more in May. This is on steady demand and good supply.

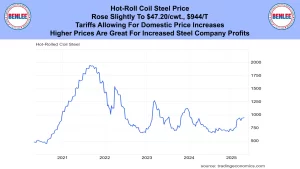

Hot-rolled coil steel price rose slightly to $47.20/cwt., $944/T. Tariffs are allowing for domestic price increases. Higher prices are great for increased steel company profits.

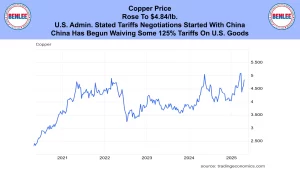

Copper price rose to $4.84/lb. The U.S. administration stated tariff negotiations started with China. Also, China has begun waving the 125% tariffs on some U.S. goods

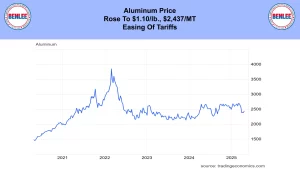

Aluminum price rose to $1.10/lb., $2,437/mt. on the easing of tariffs.

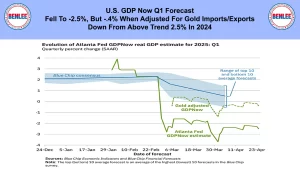

U.S. GDP Now Q1 Forecast fell to -2.5%, but is only down -.4% when adjusted for gold imports and exports. This is down from the above trend +2.5% in 2024.

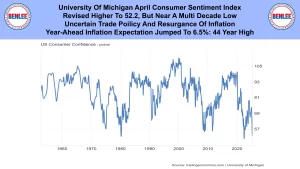

University of Michigan April consumer sentiment index was revised higher to 52.2, but still near a multi decade low. This was on the uncertain trade policy and the resurgence of inflation. Year ahead inflation expectations jumped to 6.5% a 44 year high.

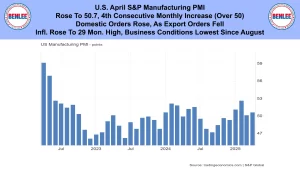

U.S. April S&P Manufacturing purchasing managers’ index rose to 50.7 the 4th consecutive monthly increase, meaning it was over 50. Domestic orders rose, as export orders fell. Inflation rose to a 29 month high as business conditions were the lowest since August.

U.S. March existing home sales slumped by 5.6% from February to 4.02M annualized on high mortgage rates and high prices.

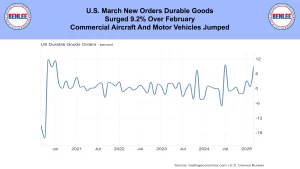

U.S. March new orders of durable goods surged 9.2% over February. This was as orders for commercial aircraft and motor vehicles jumped.

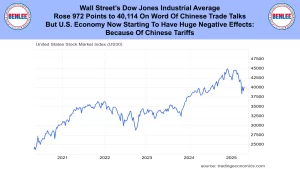

Wall Street’s Dow Jones Industrial Average rose 972 points to 40,114 on word of Chinese trade talks, but the U.S. economy is now starting to have huge negative effects because of the Chinese tariffs. On the positive, the administration stated they have made 200 trade deals.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.