April 21, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, April 21st, 2025.

U.S. weekly raw steel production fell to 1.689MT down .4% from last year and down 1.3% year to date. U.S. products that include steel have higher prices now, which is hurting domestic and export demand.

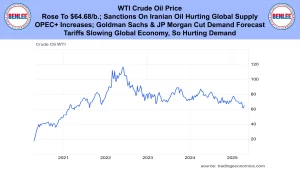

WTI crude oil price rose to $64.68/b. Sanctions on Iranian oil are hurting global supply but OPEC+ has announced oil production increases, as Goldman Sachs and JP Morgan have cut their oil demand forecast. Importantly, tariffs are slowing the global economy so that is hurting demand.

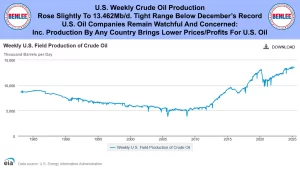

U.S. weekly crude oil production rose slightly to 13.462Mb/d., staying in a tight range, below December’s all-time record high. U.S. oil companies remain watchful and concerned. Increased oil production by any country brings lower prices and profits for U.S. oil companies.

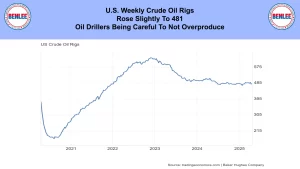

The U.S. weekly crude oil rig count rose slightly to 481 as oil drillers are being careful to not overproduce.

Scrap steel #1 HMS composite price was steady at $362/GT on a good supply with steady demand.

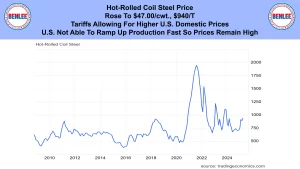

Hot-rolled coil steel price rose to $47.00/cwt., $940/T as tariffs are allowing for higher U.S. domestic prices. The U.S. is not able to ramp up production fast enough, so prices remain high.

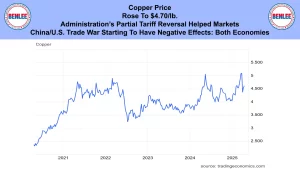

Copper price rose to $4.70/lb. The administration’s partial tariff reversal helped markets. But the China/U.S. trade war is starting to have negative effects on both economies.

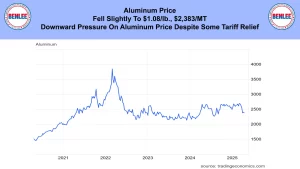

Aluminum price fell slightly to $1.08/lb., $2,383/MT. There is downward pressure on aluminum prices despite some tariff relief.

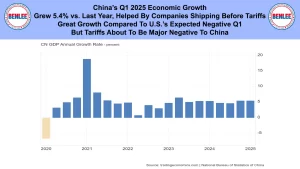

China’s Q1 2025 economic growth, was 5.4% vs last year, helped by companies shipping before tariffs. This is great growth compared to the U.S.’s expected negative Q1 but tariffs are about to be a major negative to China.

U.S. Dollar index, which is the U.S. dollar vs other global currencies. A currency falls when other countries are concerned about the country and do not invest in the country’s bonds. It fell to 99.2, near a 3 year low on U.S. tariff policy uncertainty. A lower dollar means imports are more expensive for us and our exports are cheaper for others to buy.

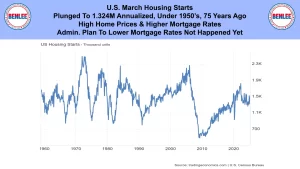

U.S. March housing starts plunged to 1.324 million annualized, under from the 1950s, 75 years ago. This was on high home prices and higher mortgage rates. The Administration’s plan to lower mortgage rates has not happened yet.

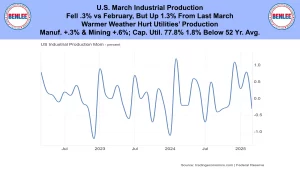

U.S. March industrial production fell .3% vs February, but up 1.3% from last March. Warmer weather hurt utilities’ production. Manufacturing was up .3%, mining up .6%, but capacity utilization was 77.8%, 1.8% below the 52 year average.

U.S. March retail sales jumped 1.4% over February. Excluding autos, it was up .5% as buyers bought to beat tariffs.

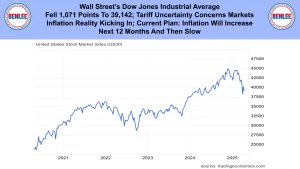

Wall Street’s Dow Jones Industrial Average fell 1,071 points to 39,142. Tariff uncertainty concerns markets as inflation reality is kicking in. The current plan is that inflation will increase for the next 12 months and then slow.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.