Commodities, Scrap Metal, Recycling and Economic Report

December 4, 2023

Watch Report - Listen to Podcast

This is the Commodities, Scrap Metal, Recycling and Economic Report, December 4th, 2023.

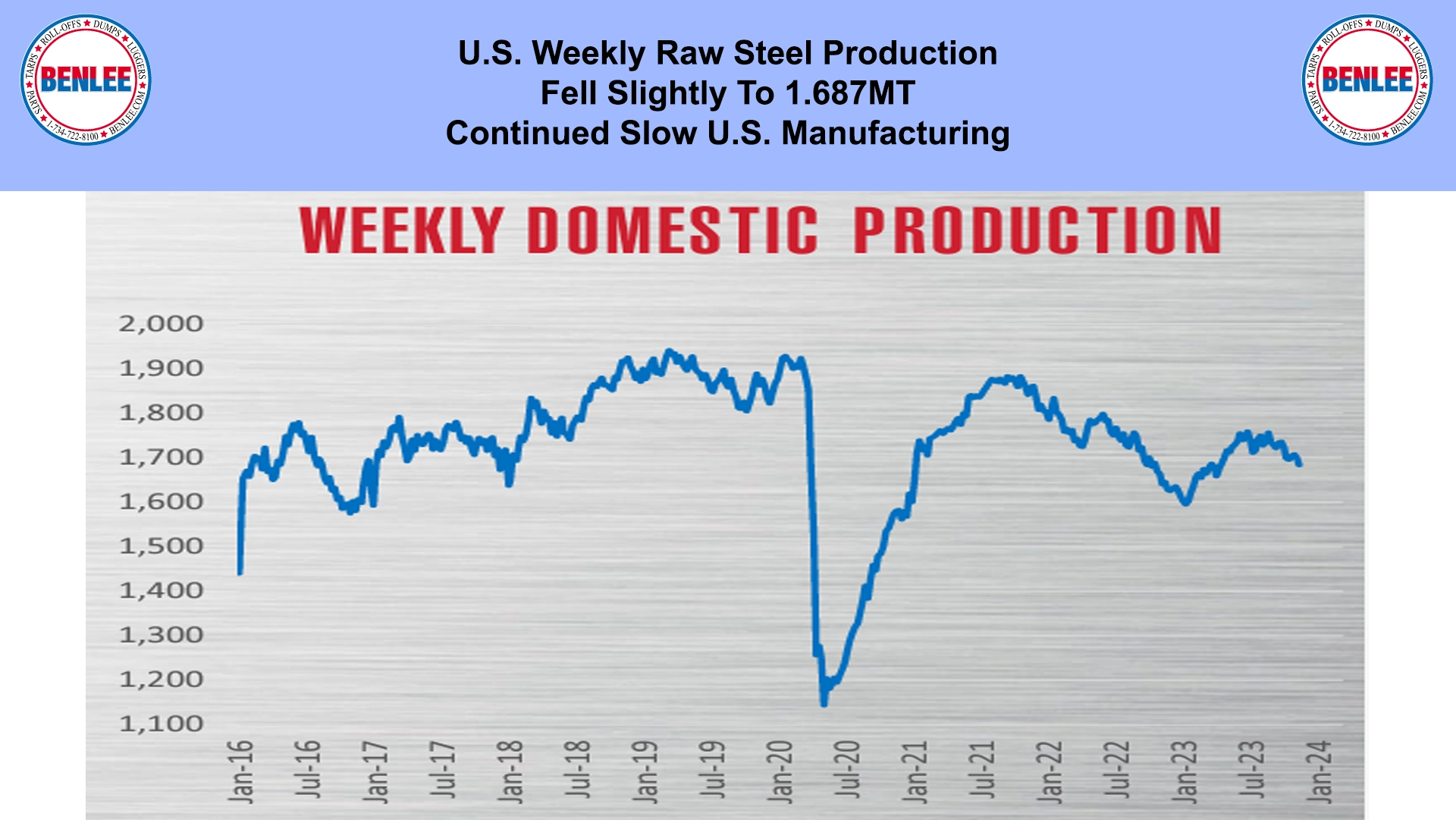

U.S. weekly raw steel production fell slightly to 1.687MT on continued slow U.S. manufacturing.

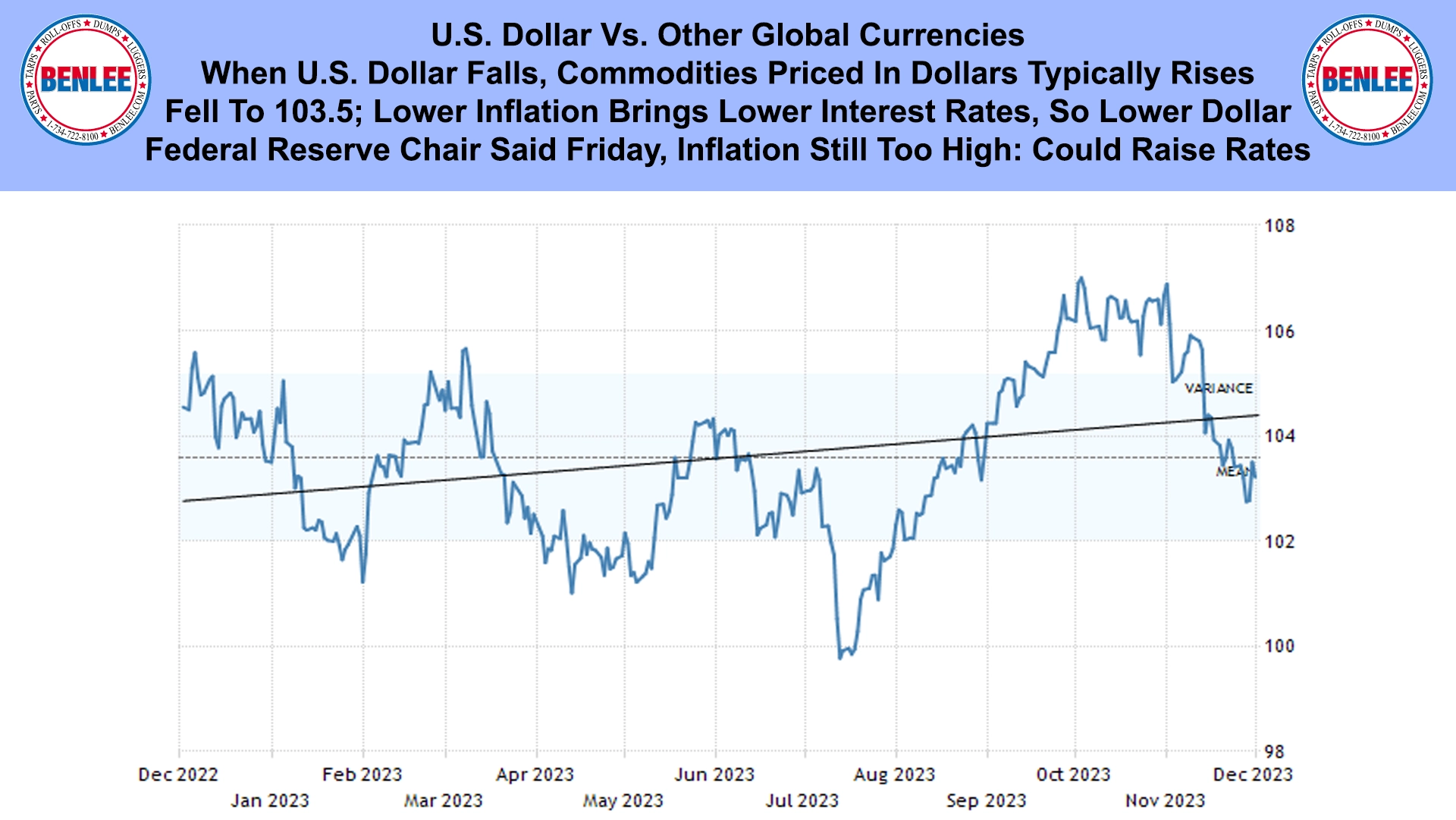

The U.S. dollar vs other global currencies. When the dollar falls, commodities priced in dollars typically rises. It fell to 103.5 as lower inflation brings lower interest rates, so a lower dollar. But the Federal Reserve Chair said on Friday inflation is still too high, so they could raise interest rates.

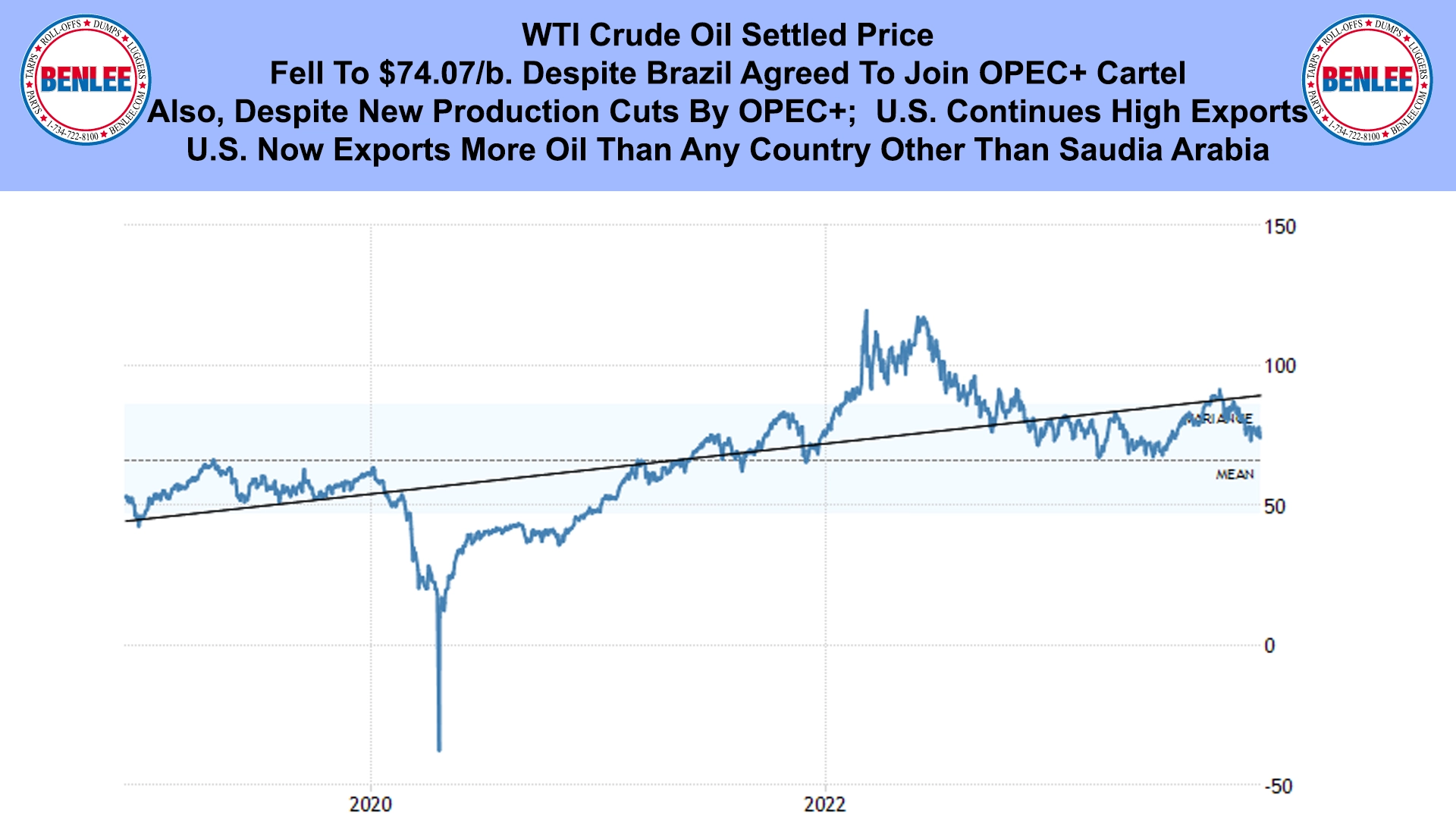

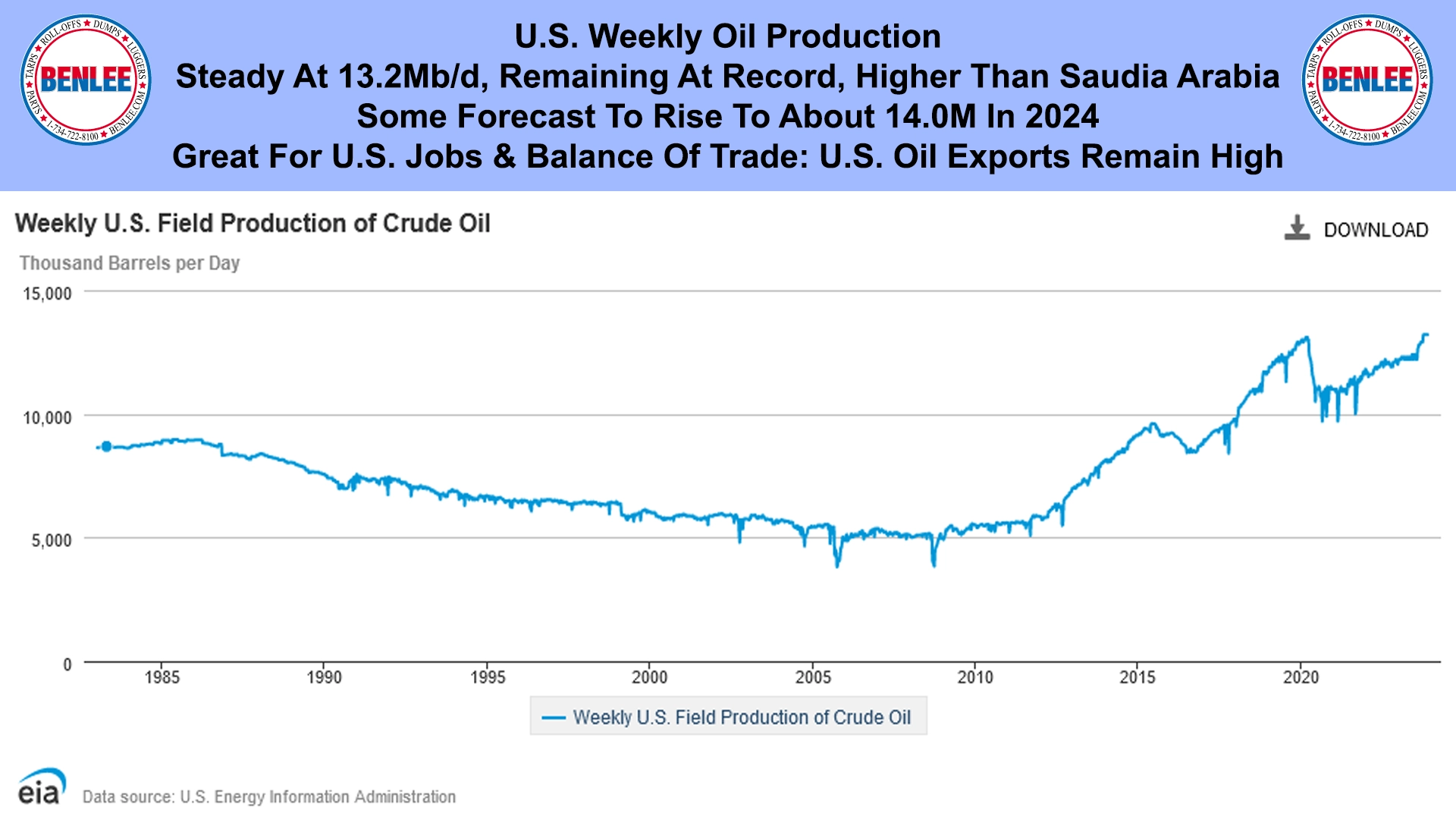

WTI crude oil settled price fell to $74.07/b., despite Brazil agreed to join OPEC+. Also, the lower price came despite new production cuts by OPEC+ while the U.S. continues high exports. The U.S. now exports more oil than any other country in the world other than Saudia Arabia.

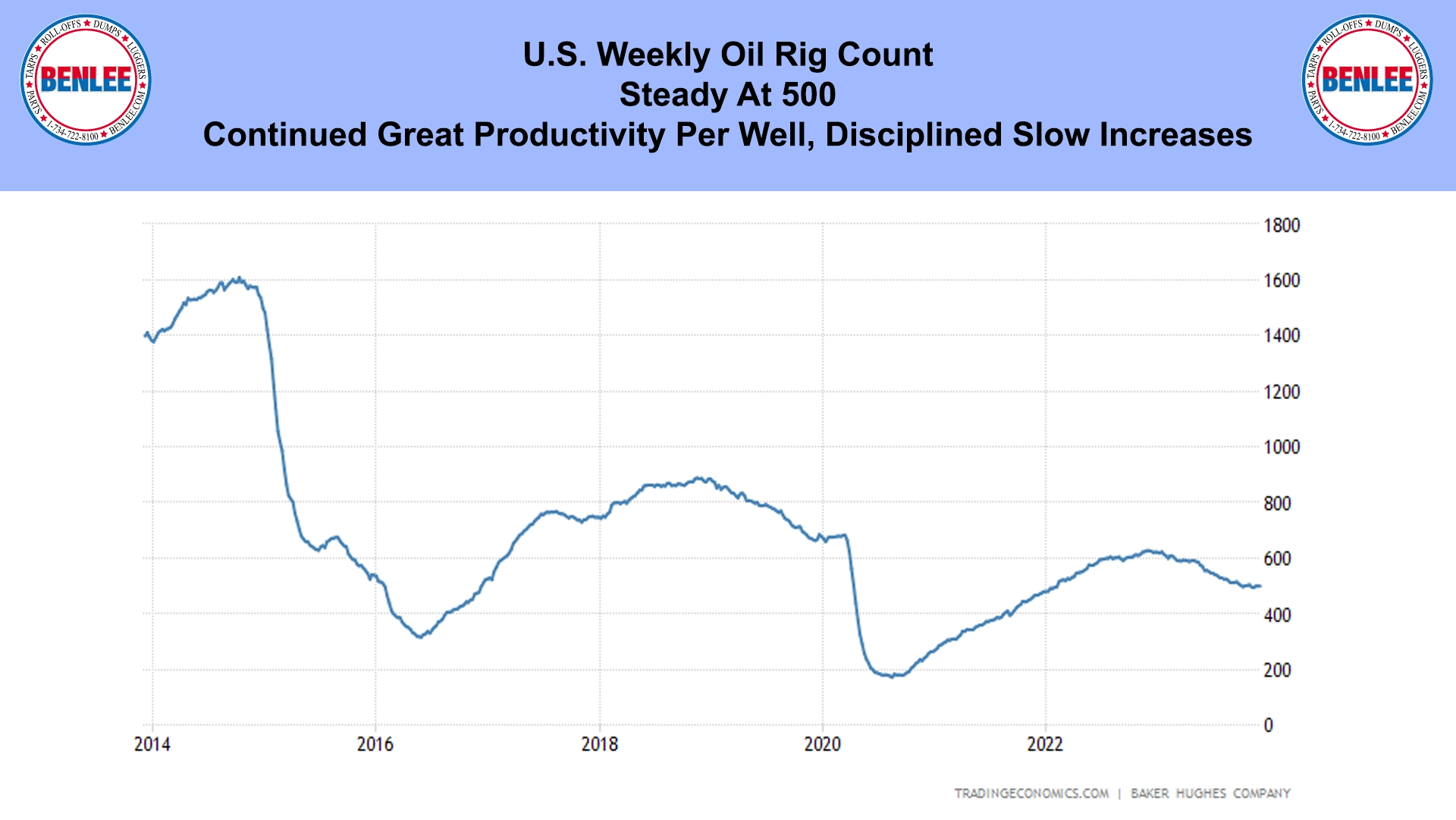

The U.S. weekly oil rig count was steady at 500. This was on continued great productivity per well and disciplined very slow increases.

U.S. weekly oil production was steady at 13.2Mb/d., remaining at the record and is higher than even Saudi Arabia. Some forecast production to rise to about 14.0M in 2024. Great for U.S. jobs and the balance of trade as U.S. oil exports remain high.

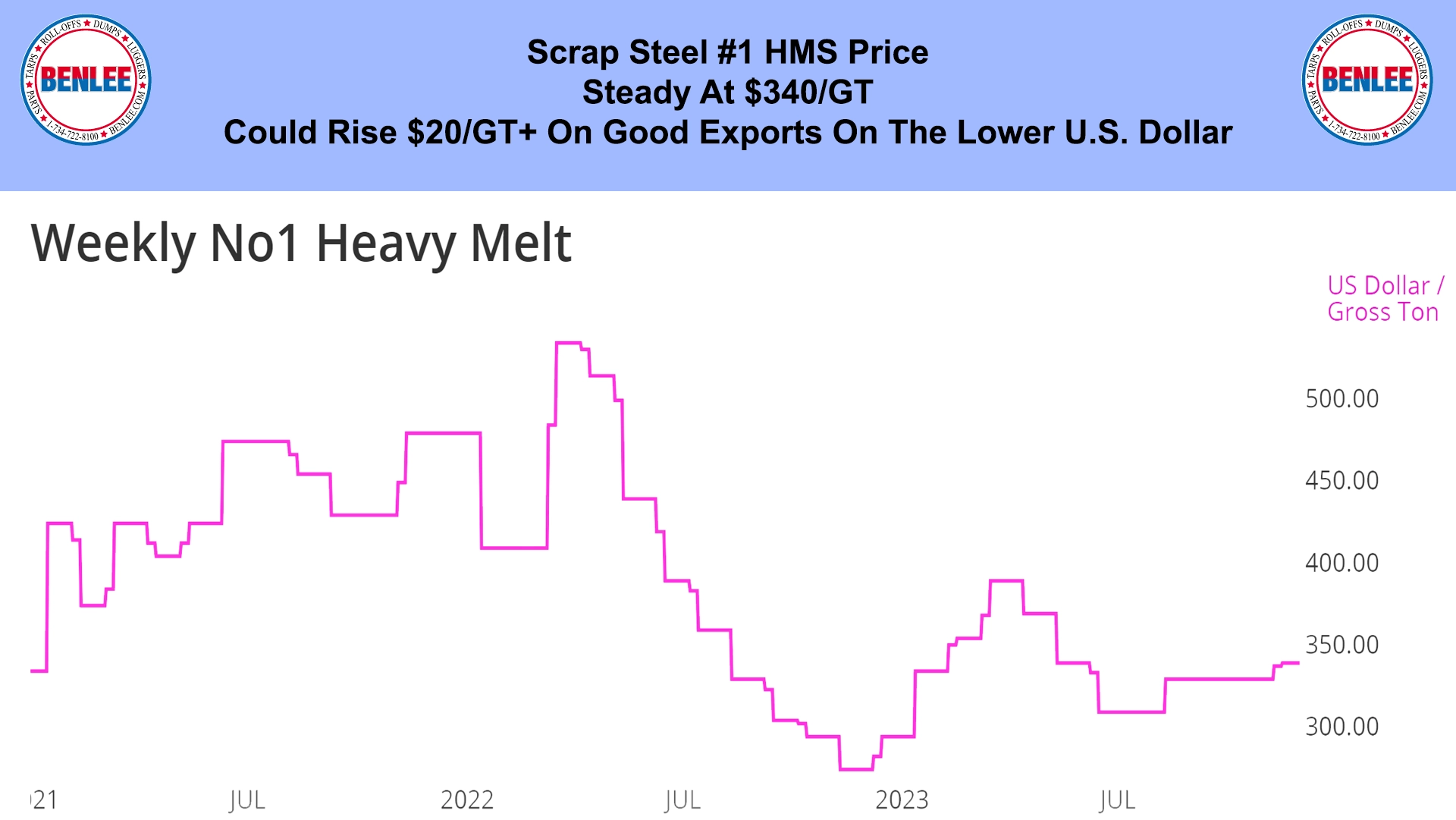

Scrap steel #1HMS price was steady at $340/GT. It could rise $20/GT or more this week on good exports, due to a lower U.S. dollar.

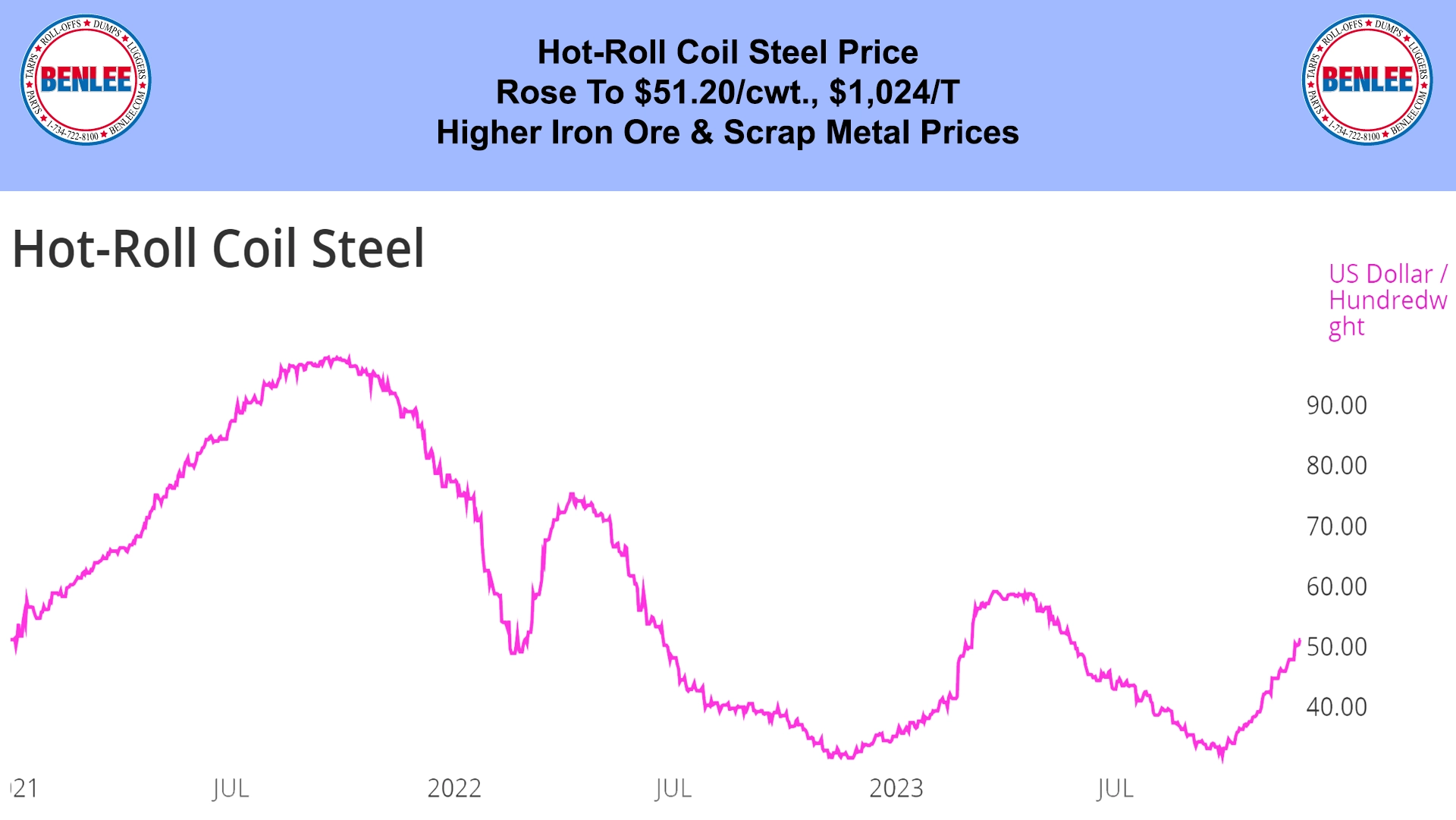

Hot-rolled coil steel price rose to $51.20/cwt., $1,024/T on higher iron ore and scrap metal prices.

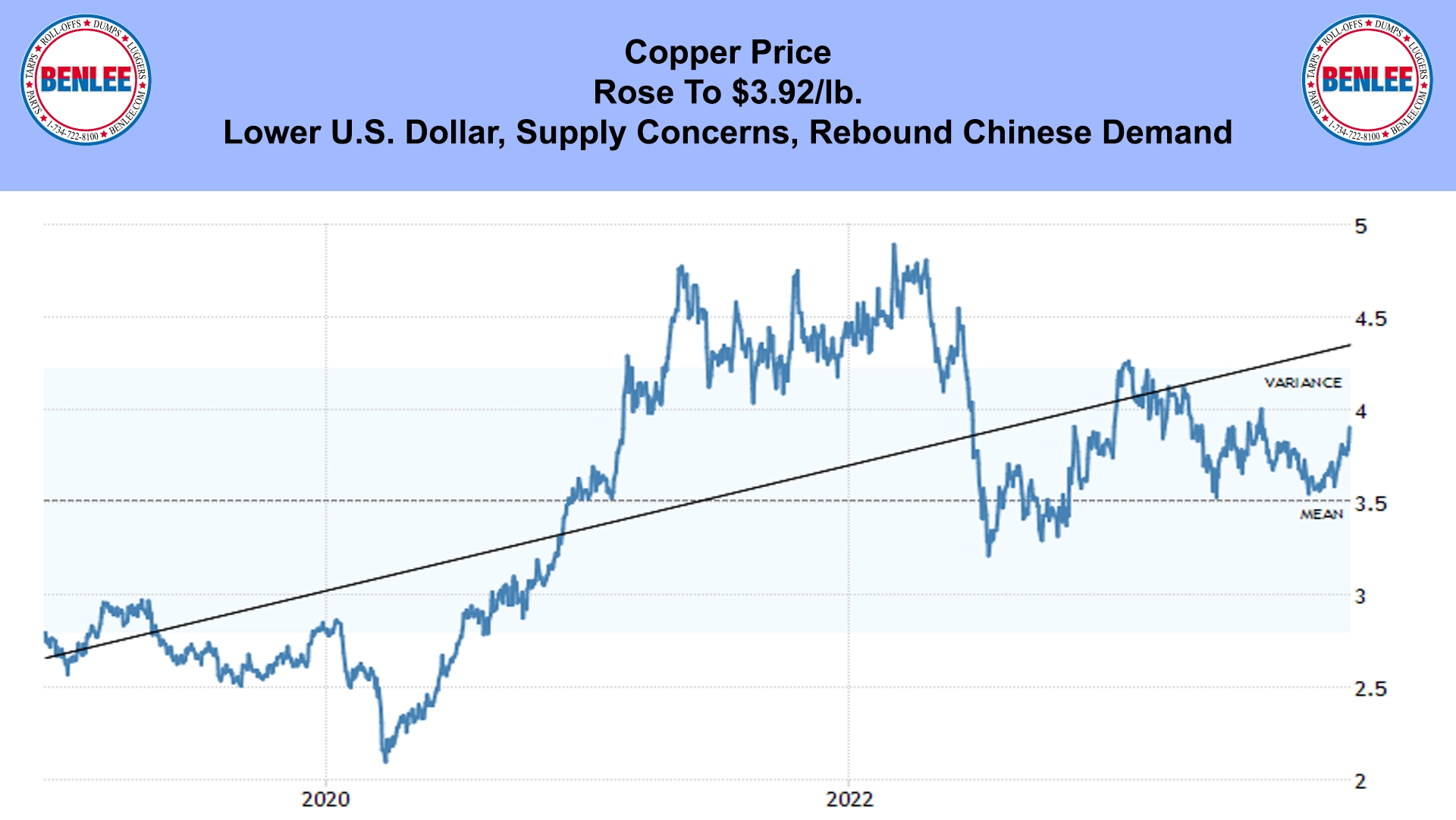

Copper price rose to $3.92/lb., on the lower U.S. Dollar, supply concerns and the rebound in Chinese demand.

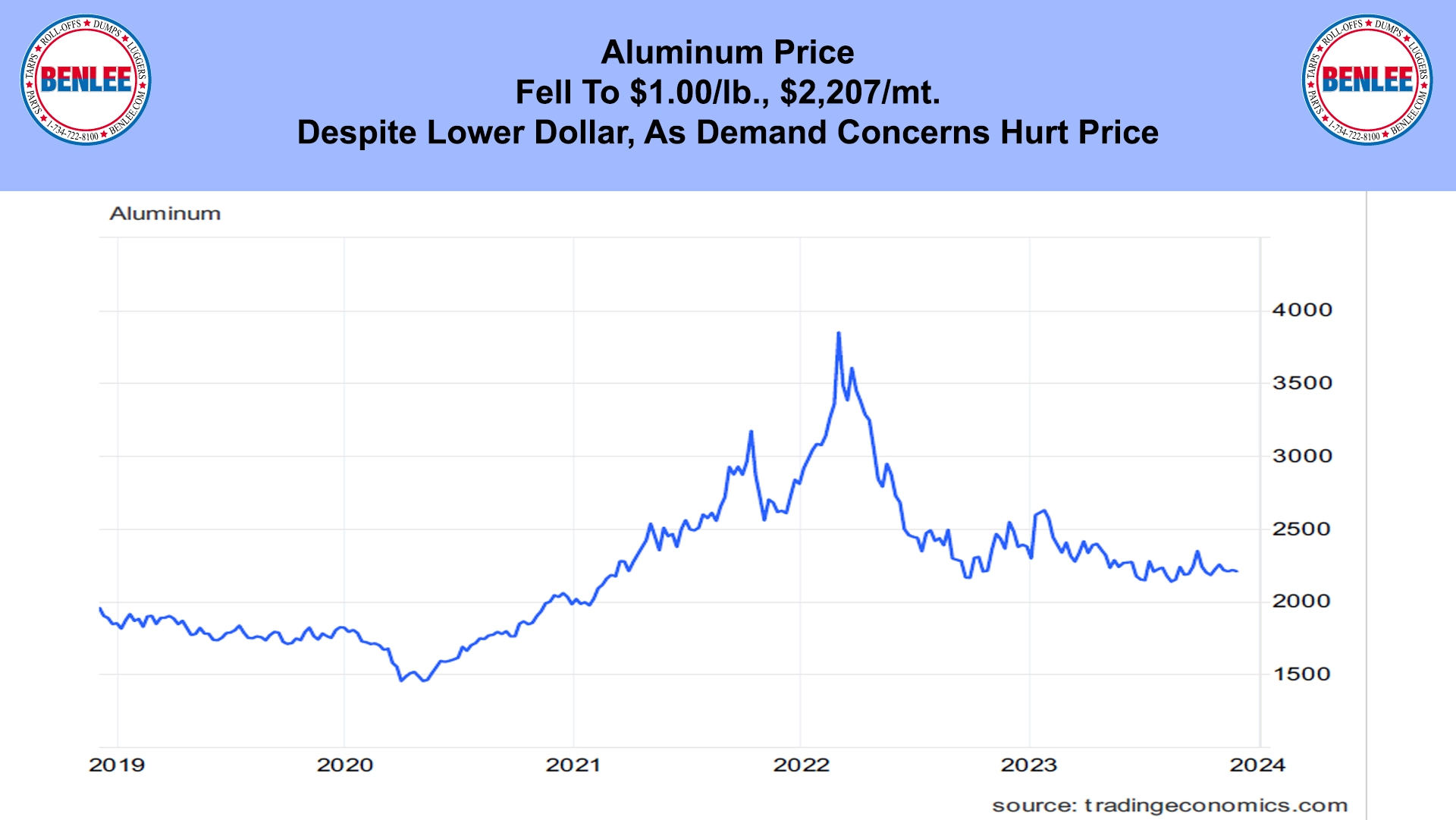

Aluminum price fell to $1.00/lb., $2,207/mt. This was despite the lower dollar and demand concerns hurt price.

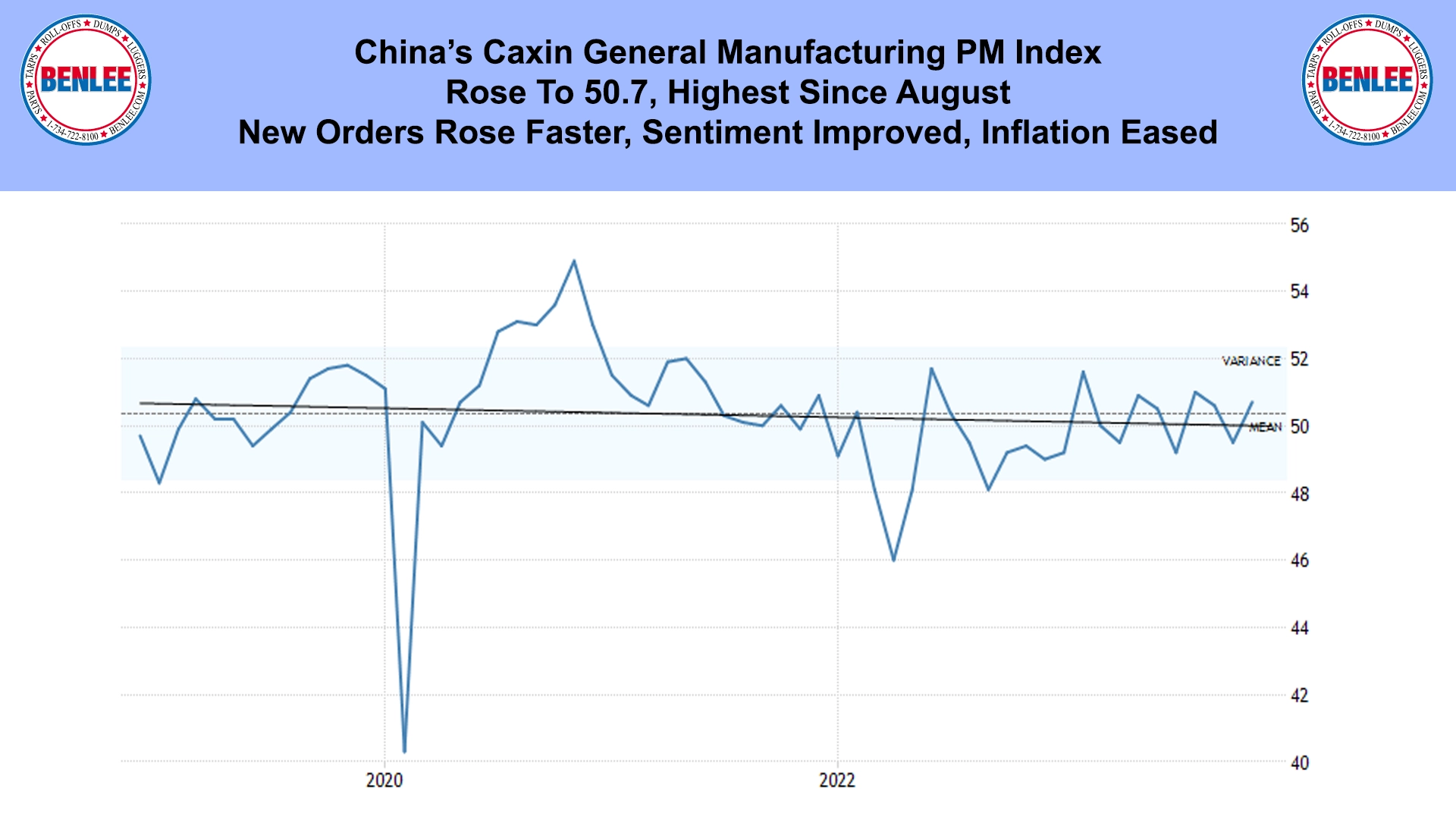

China’s Caxin general manufacturing purchasing manager’s index rose to 50.7 the highest since August. This was as new orders rose fast, sentiment improved and inflation eased.

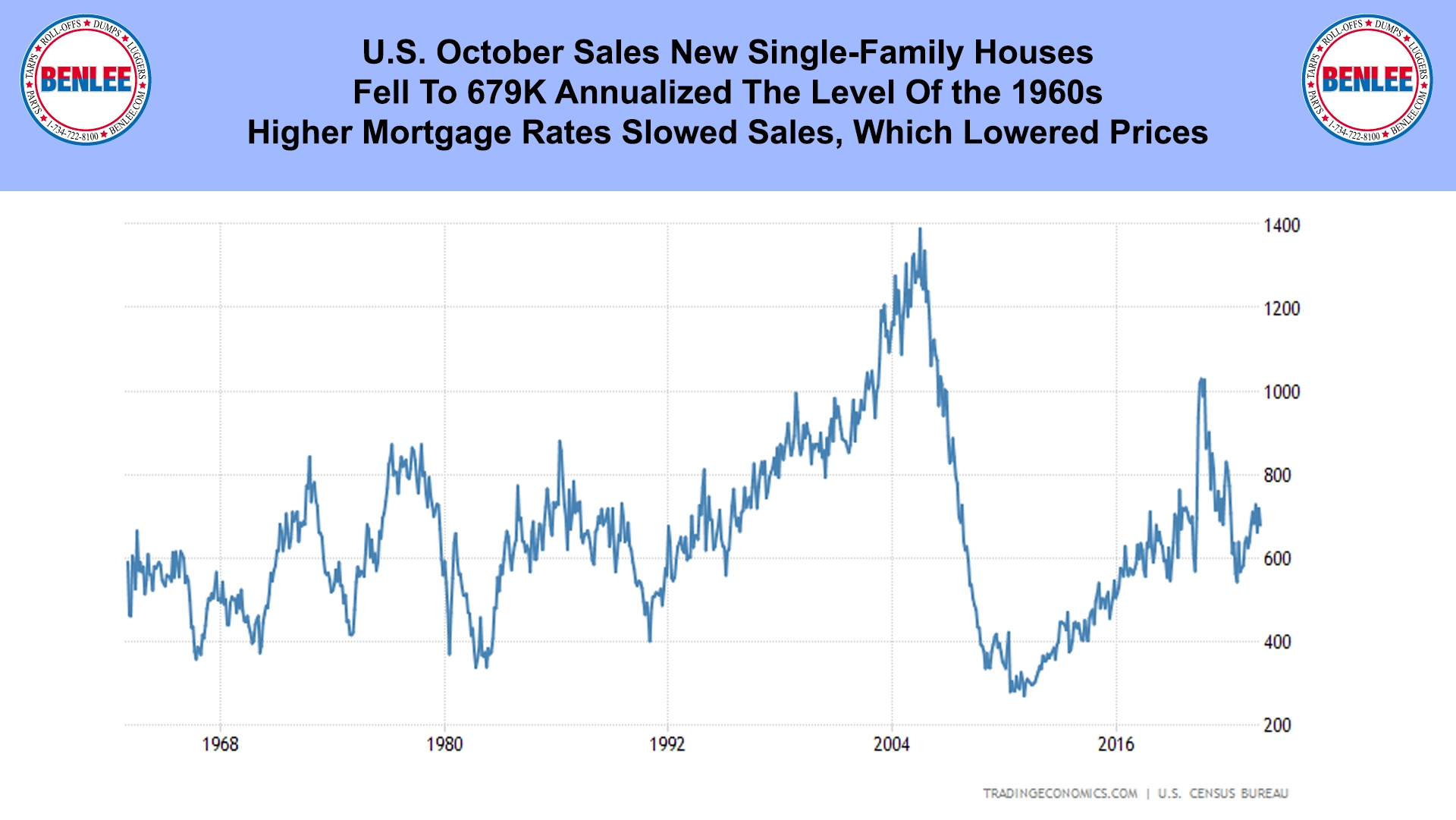

U.S. October sales of new single family houses fell to 697,000 annualized, the level of the 1960’s as higher mortgage rates slowed sales, which lowered prices.

U.S. November ISM manufacturing purchasing managers’ index was unchanged at 46.7, the 14th month of under 50. Remember under 50 is contraction. New orders remain soft, inventories continue to shrink and prices fell.

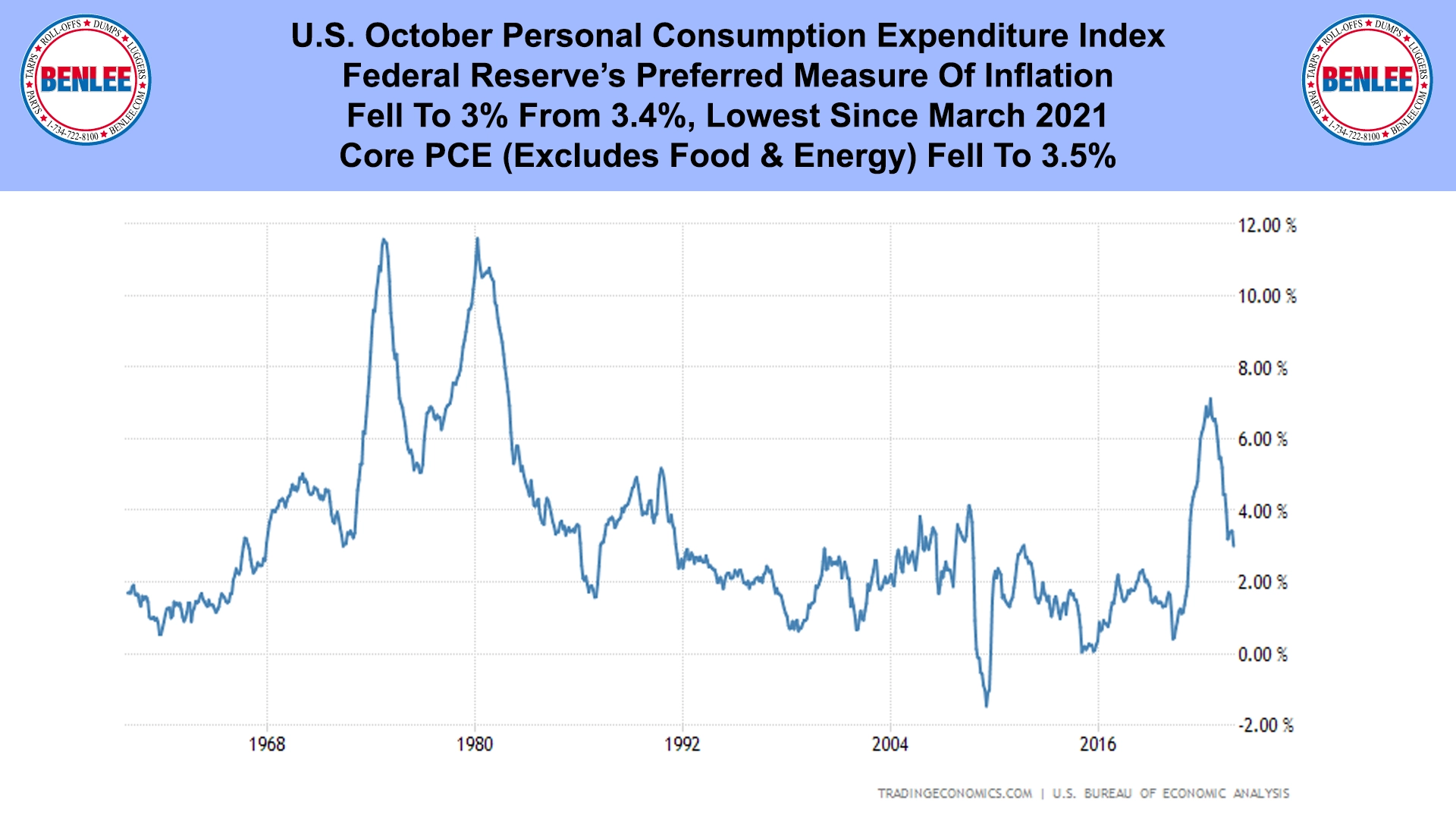

U.S. October personal consumption expenditure index, the Federal reserve’s preferred measure of inflation. It fell to 3% from 3.4%, the lowest since March 2021. Core PCE, which excludes food and energy, fell to 3.5%.

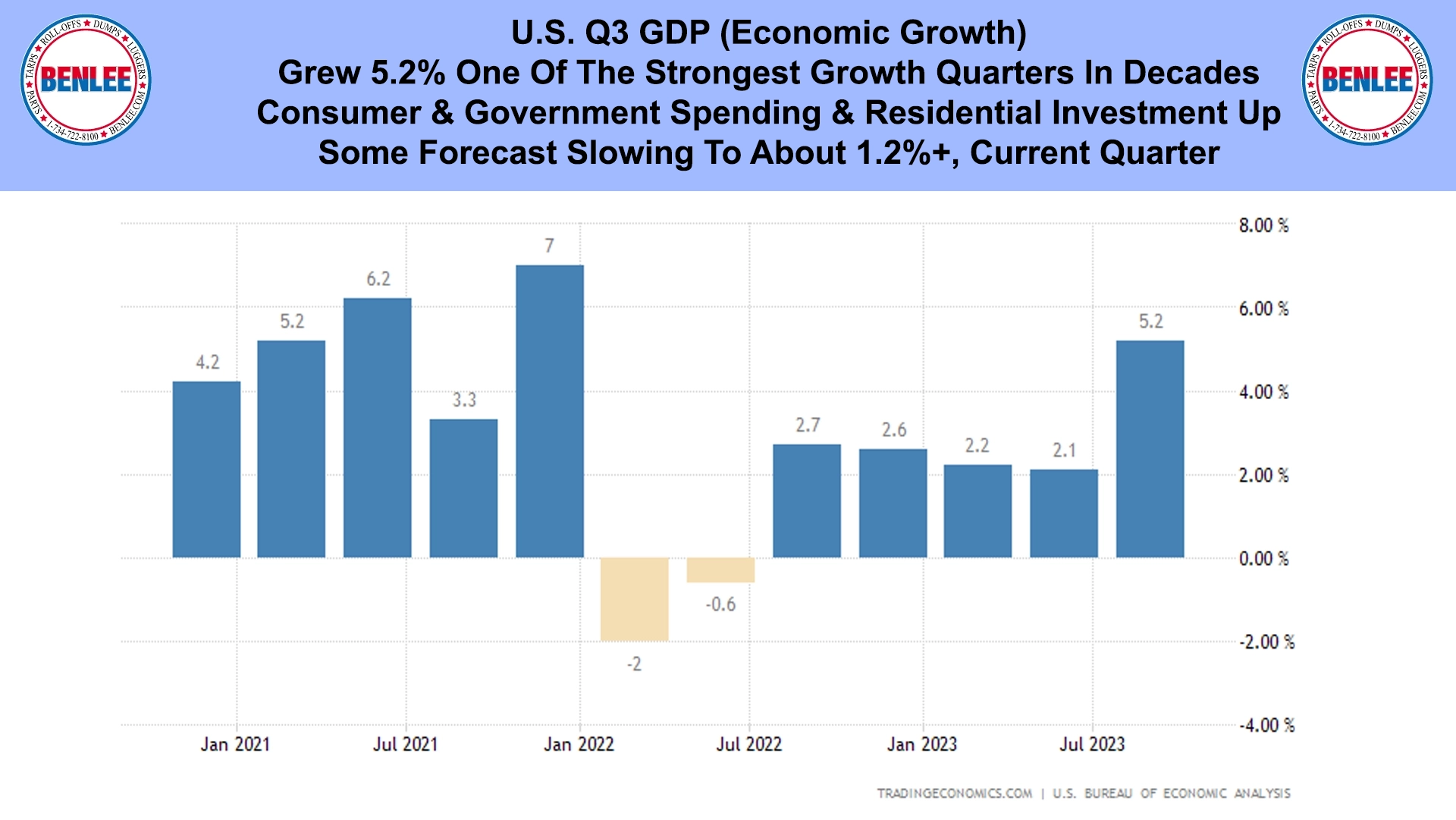

U.S. Q3 GDP, economic growth. The economy grew 5.2% over last year, one of the strongest growth quarters in decades. Consumer and government spending as well as residential investments were up. Some forecast slowing to about 1.2%+ in Q4, the current quarter.

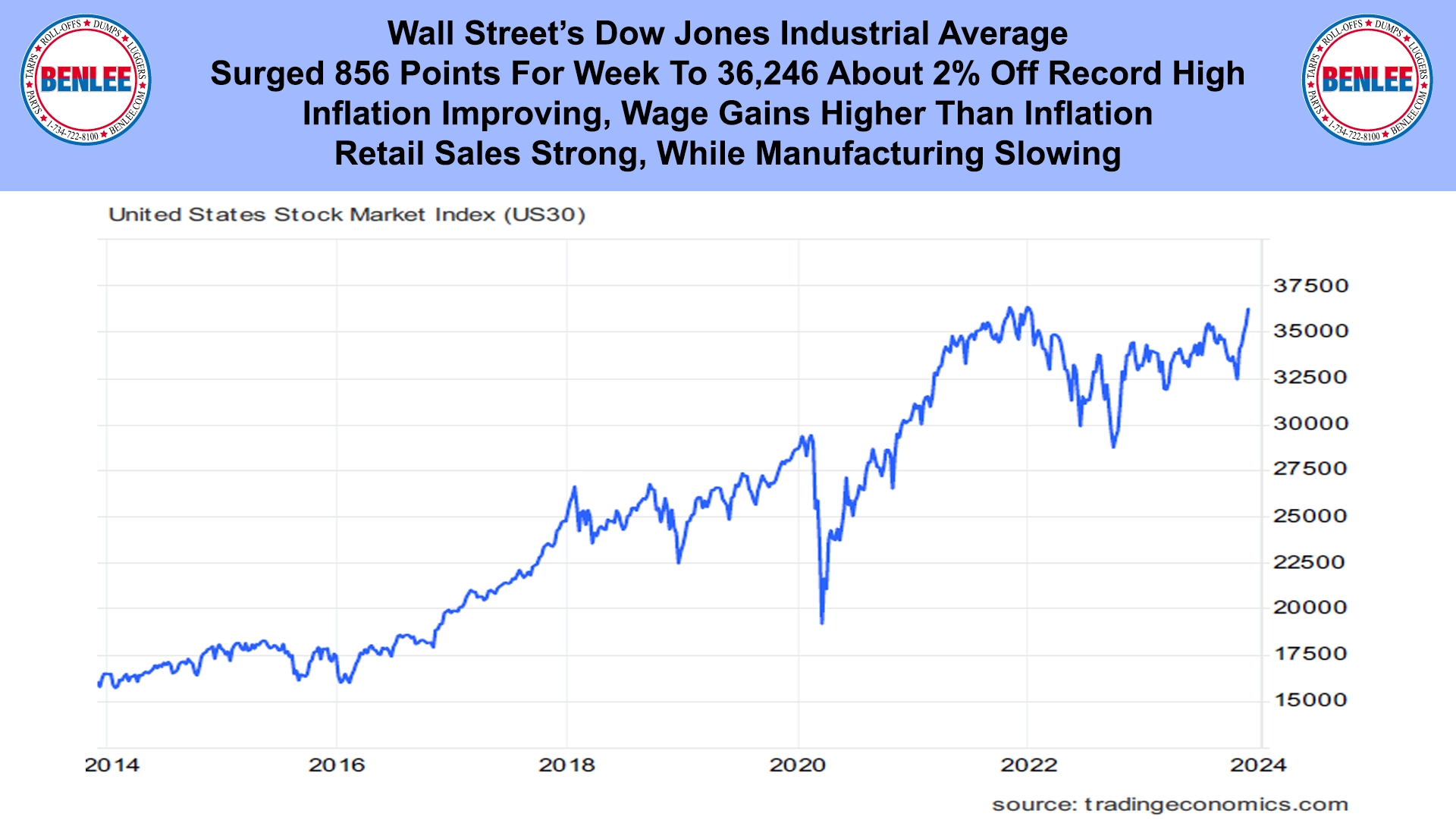

Wall Street’s Dow Jones Industrial Average surged 856 points for the week to 36,246, about 2% off the all-time record high. Retail sales were strong, while manufacturing was slowing.

This report is brought to you by BENLEE roll off trailers, gondola trailers, lugger trucks and roll off trailer parts.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.

Links:

BENLEE Roll off Trailers, Lugger Trucks and Roll off Parts

Roll off Parts, Roll off Truck Parts, Roll off Trailer Parts, Tarp System Parts

Galbreath Hoist Parts

Roll Off Trailers for Sale

Search BENLEE